In this article, we will look at the term “gap”. We will look at what a gap is, how to deal with gaps and some statistics about gaps in the DAX.

What is a Gap?

A gap is a “hole” in the price chart. It is the difference between the closing price and the opening price of an instrument. On the foreign exchange markets, we close Friday evening at 11:00 pm and open again on Sunday evening at 23:00. There can happen a lot on a weekend that can influence exchange rates and thus result in a difference between closing and opening price. Here we often see gaps, but only once a week because the foreign exchange markets are only closed during weekends. However, DAX close each evening at 22:00 and open again at 08:00. Here we see gaps on around 80% of the days (see statistics at the bottom of the article).

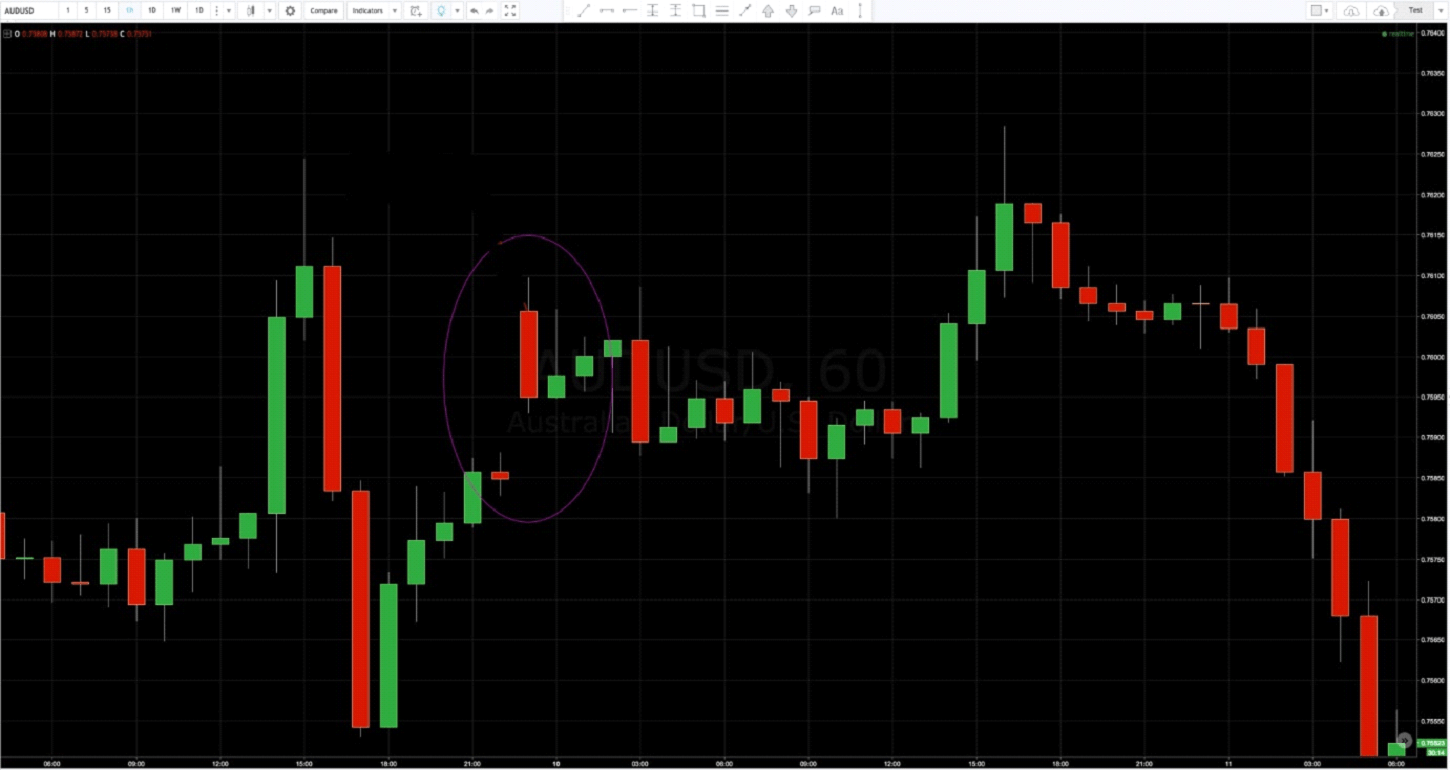

Below is an example of a gap. This is in the AUDUSD exchange rate (9.10.16 on the H1 time frame).

These gaps are often closed fairly quickly again. However, it is worth noting that the greater the gap, the longer it typically goes before it closes. In addition, not all gaps are closed. For example, there are still three open gaps in EURUSD (as far as I remember) that have not been filled yet. So, it is no rule of law that all gaps must be closed, but it is very often that they close and that they close quickly (either the same day or within two to three days).

Strategies for Gap Trading

Now that we know that these gaps are closed often and quickly, we need to utilize this information. One can either try to develop a completely mechanical strategy, such as short of an upward gap with a fixed stop-loss and target, or you can incorporate gaps into one’s normal discretionary trading and use the open gap as a target for trading and also use it as a bias for one’s analysis and setups.

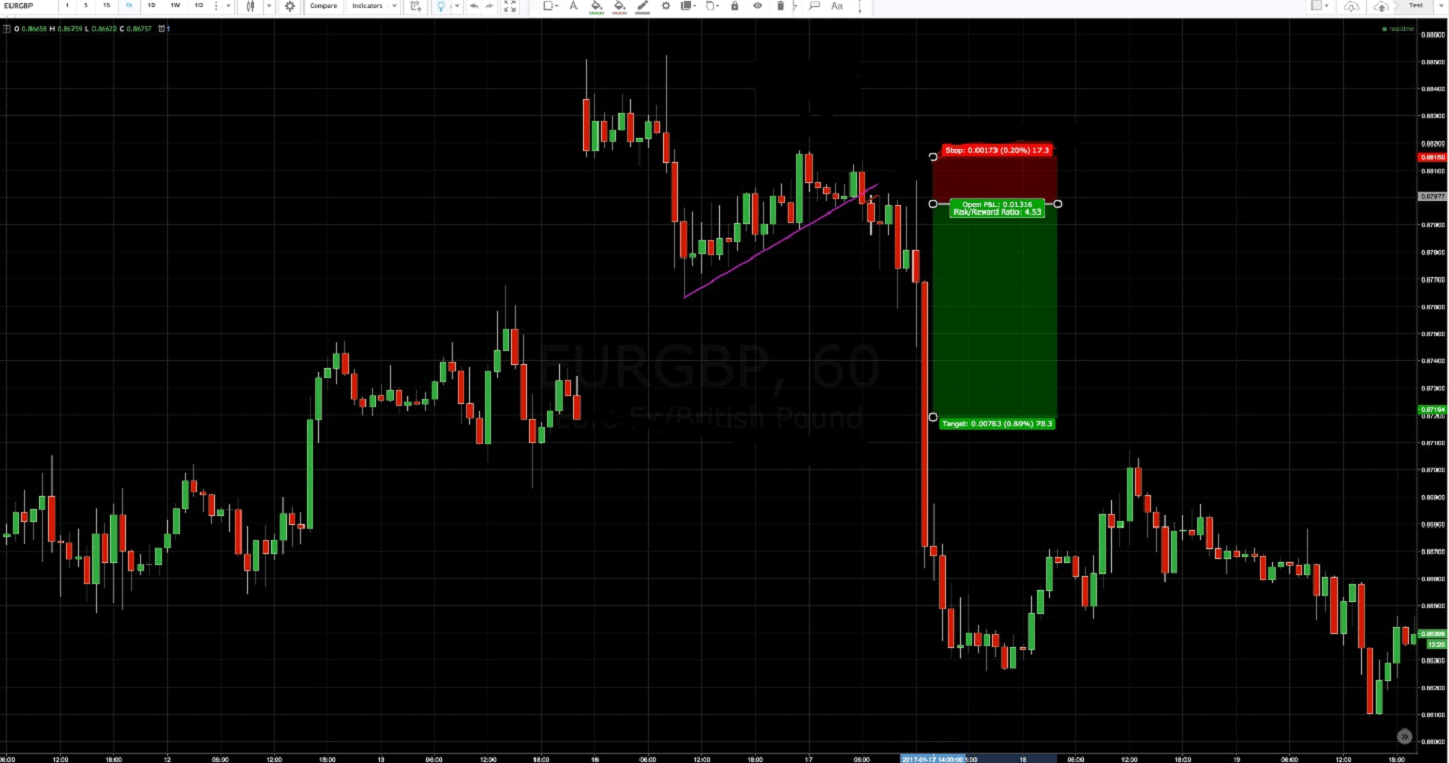

For example, you could use a simple close outside of an entry line and use the open gap as a target. Such a setup is illustrated below on EURGBP on the H1 chart from 17.1.2017.

Personally, I’m mostly using the open gap as bias for my trades and if I get a setup then I know I have the odds on my side generally.

Gap statistics on DAX

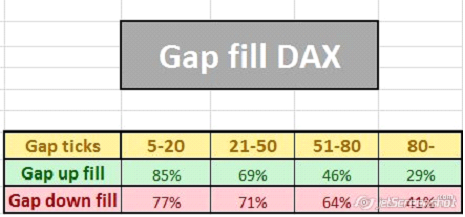

As always, I try to back up my claims and theories with statistics whenever possible. In DAX, where we have gaps almost every day, an analysis of gaps is interesting. I have analyzed data back from September 2009 up to today (13.2.2017) and have studied all the gaps that have a minimum gap of 5 ticks.

In general, there is a good likelihood that we will close a gap the same day. Gaps down close a little more often than gaps upwards, and this must be due to the general upward trend in the stock market. In DAX, we have an historical probability of 77% to fill any gap down there is over 5 ticks, and 73% probability of filling up any gap up to a size of over 5 ticks.

In addition, we can also see that the likelihood of a gap filling on the same day decreases, the greater the gap is.

The data on gaps on DAX can be downloaded here: DAX GAP fill

Questions or comments?

Let us know if you have any questions or comments.