In this article, we review the UK broker, London Capital Group (LCG), which we have been invited to review. LCG is a well-known English broker, which has been around for 14 years.

They offer trading with CFDs as well as spreadbetting for their English customers.

We rate them as our other reviews on the following parameters:

- Security

- Product Selection

- Trading platforms

- Trading costs

- Charting package

- Customer service

- Demo Account

- Bonuses

About LCG

LCG was founded in 2003 in London, where they have their headquarters. Earlier, they were called Capital Spreads, but have recently changed their name. They are also listed on the London Stock Exchange.

One can trade the most popular markets like stocks, commodities, forex, bonds and even options.

They also offer white-labeling solutions, allowing companies to buy into the LCG platform and use their model.

Safety at LCG

LCG has a license in London and is subject to the strict requirements of the English FCA, which means that the customers are covered by the English legislation with regard to depositor’s guarantee, etc.

An important factor is that they operate with a so-called “negative account policy”, which means that the customer can lose more than the amount in the account. To many, this is an important factor, as daytraders often operate with high gearing and thus take great risks. This counts in our assessment that this kind of security is not granted. However, they offer a guaranteed stop-loss (paid).

Products at LCG

LCG offers trading in the most popular products. They cover the most important markets. Here’s what they offer trading in:

- Shares

- Commodities

- Forex

- Stock indices

- Futures

- Vanilla options (not binary options)

- Bonds

The need should be covered for the majority of daytraders. It is clearly a plus that they choose to offer Vanilla options and not the Binary options.

Trading platforms at LCG

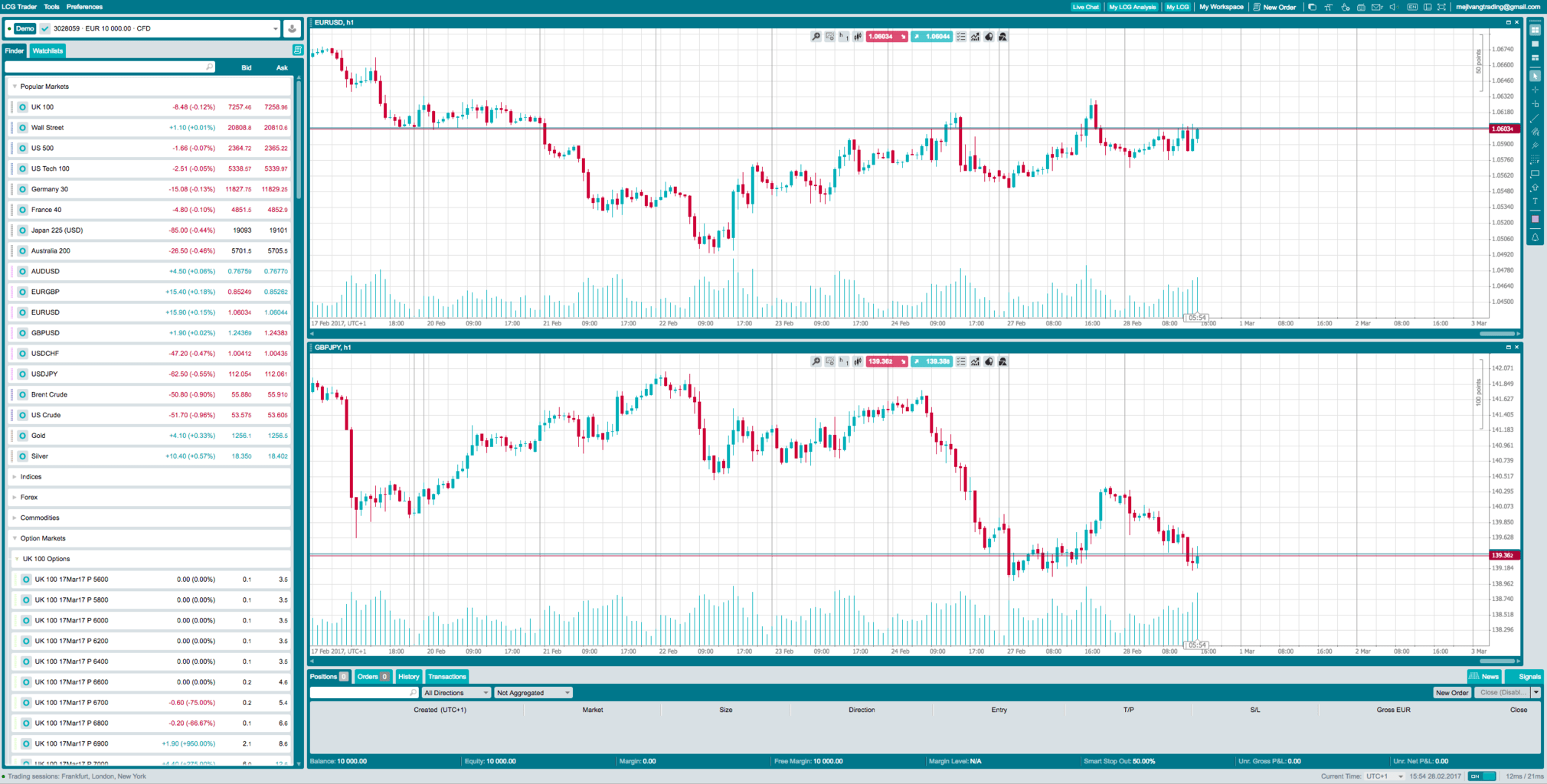

LCG has two trading platforms, their own web-based platform LCG Trader, and the well-known MT4 platform. We have chosen to review their own platform, LCG Trader.

First impressions of LCG Trader are really good. To be honest, it really reminds you about most brokers’ online platforms such as ETX Capitals. The design is simple and modern. The platform itself is quite flexible and intuitive. Of course, LCG Trader can also be accessed via smartphone and tablet.

A plus here is that the (tick) volume is plotted by default on any graph. This is typically a lack of many CFD platforms.

Trade costs at LCG

Their spreads are not so competitive when we compare with the other brokers we have reviewed. They are not soaring, but a bit higher than most. Their spreads are also variable so it’s hard to get a completely correct overview of the cost. You can also choose between two different account types; Classic and ECN. I have taken prices from their Classic account.

Here are their spreads in the most popular markets:

- DAX: 1.5 points

- Dow Jones: 1.8 points

- EURUSD: 1.6 points

- EURGBP: 1.5 points

- AUDUSD: 1.6 points

- USDJPY: 1.5 points

- GBPUSD: 1.7 points

- Crude Oil: 3 points

- Gold: 5 points

Spread on oil, on the other hand, is quite competitive. As mentioned before, they also offer an ECN solution where you can get lower spreads, but where there is a commission involved as well.

The charting package as a work tool

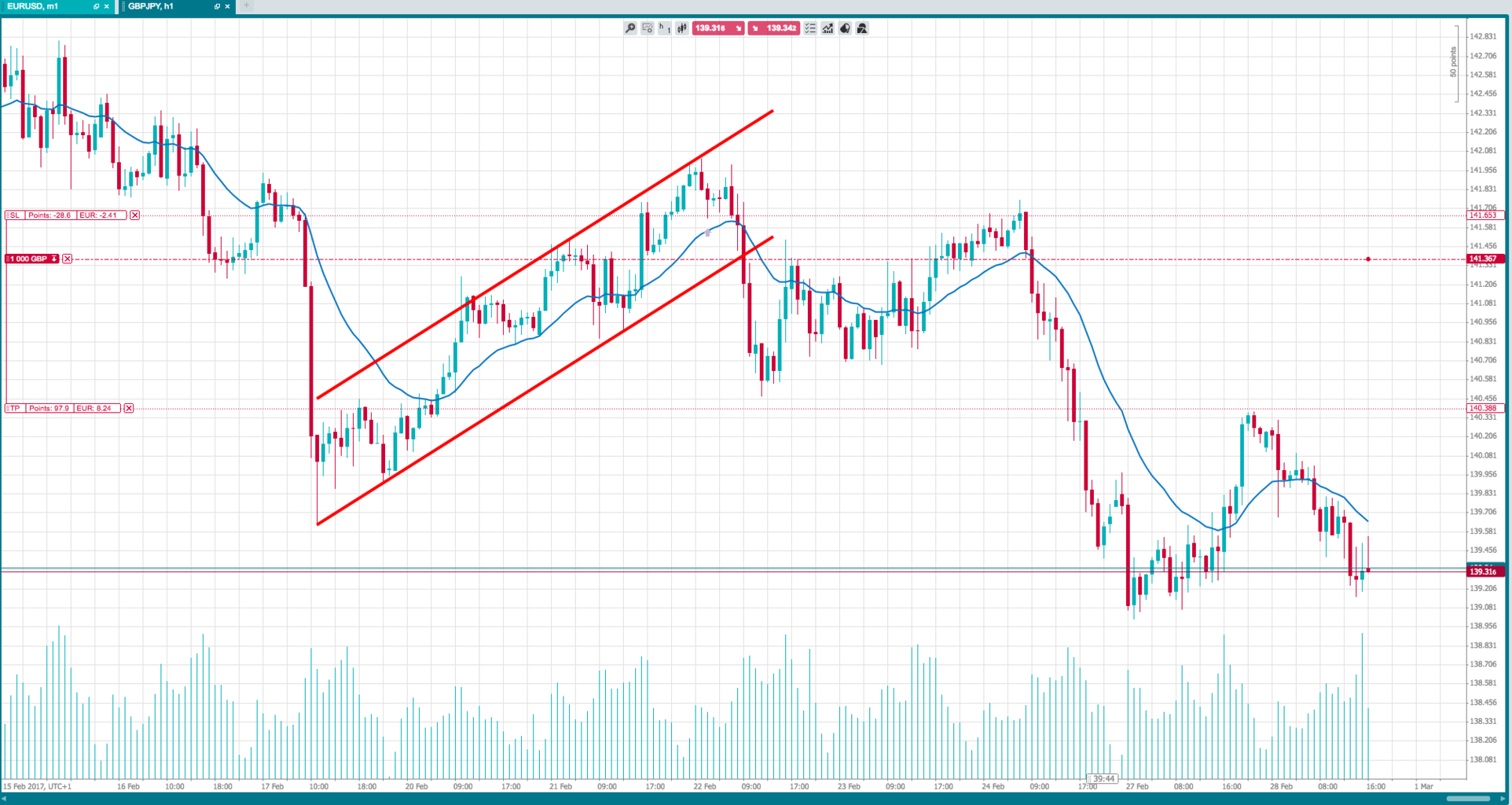

The charting package on the LCG Trader seems convincing. There are the drawing tools you need and it’s easy to add and delete items from the chart.

Here is a picture of a chart with an attached limit order. It’s great that you can see the order directly on the chart and that you can modify it graphically. In addition, you can also see how much you stand to lose/win.

You can either choose to view the price as a line graph, candlestick chart, bar chart or Heiken Ashi chart, etc. In addition, they have a wide range of indicators and overall the platform is easy to use.

Entering orders can be done using the buy and sell buttons as well as limit orders placed directly through the chart. Below is a picture of the order window that looks really nice with many details.

Customer Service at LCG

Like most others, LCG has a support center where you can get answers to most questions (FAQs). In addition, you can contact them by phone and email. They are present 24/5, which is good and during that time you can always get through to their dealing desk.

Demo account at LCG

They offer a demo account like most other brokers. At the demo account, you have the opportunity to test the platform and get used to the conditions. The demo account is not limited and you have it forever.

Bonus at LCG

LCG does not offer any kind of bonus, at least not at the time of writing. We see this as a plus, as it is usually the unserious platforms that try to attract customers with various offers and welcome bonuses, as you have a small chance of realizing those.

It seems quite aggressive and can motivate especially new daytraders to do too many trades.

Overall Rating of LCG

- Security – 3.5 points

- Product range – 5 points

- Trading platform – 5 points

- Trading costs – 3 points

- Charting package – 5 points

- Customer service – 4 points

- Demo account – 5 points

- Bonus – 5 points.

Overall Rating: 4.4 out of 5

LCG seems like an exciting platform. They have their security in check, they have a reasonable product range, their charting package is good, however, trading costs are not so competitive.

Note that we have not yet made a referral agreement with LCG as we will first follow the development of the platform before we recommend it to our readers.

Comments on the review – what are your experiences with LCG?

We would like to receive any comments with your own experiences from LCG, both good and bad. Thanks!