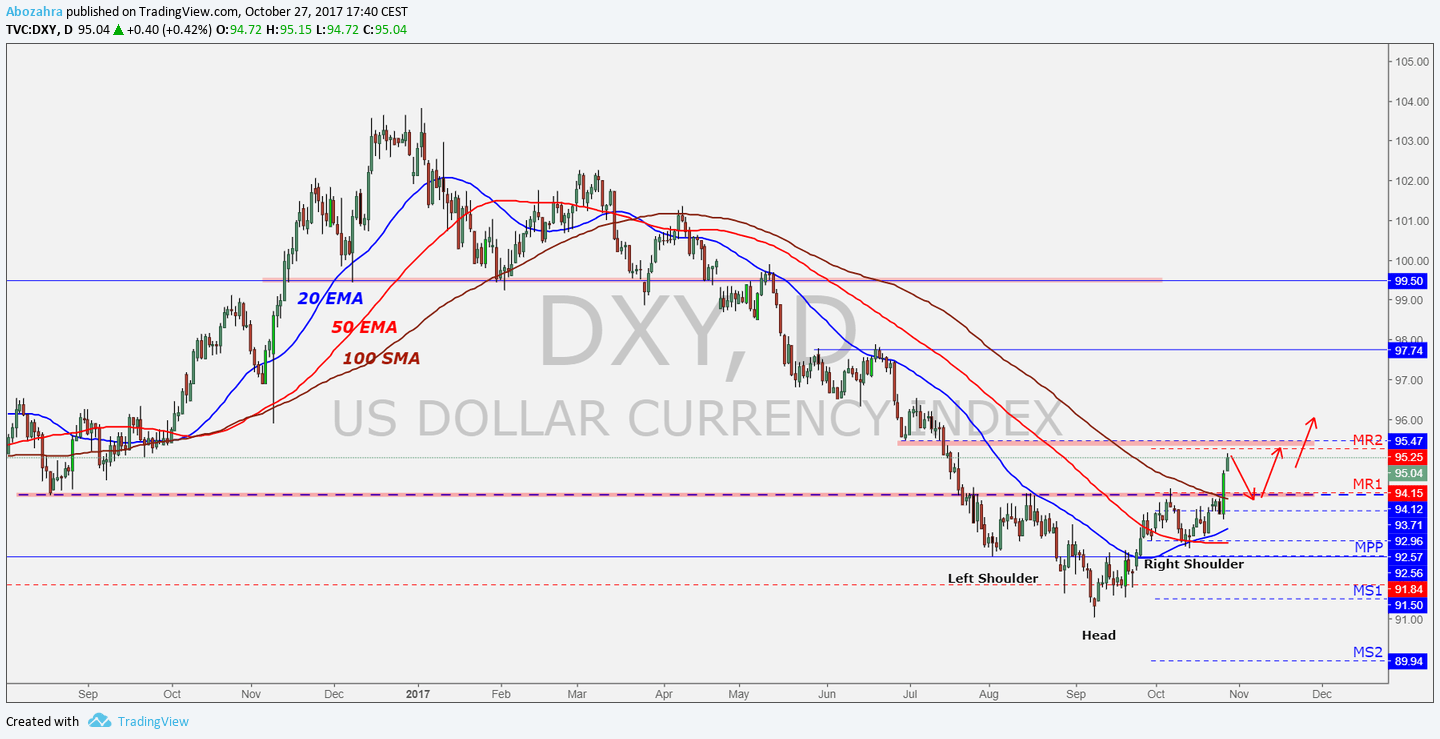

DXY the index scaled 95.000 to hit its highest level since Q3, partly on a healthy US Q3 GDP beat, but also on strong earnings and benefiting indirectly from Eur weakness in particular. The Eur was largely rangy in the run up to the ECB meeting, but then fell sharply as QE was recalibrated broadly in line with central expectations within a wide spectrum of opinion.

DXY broke a very important level and now trading above it daily 100 SMA.

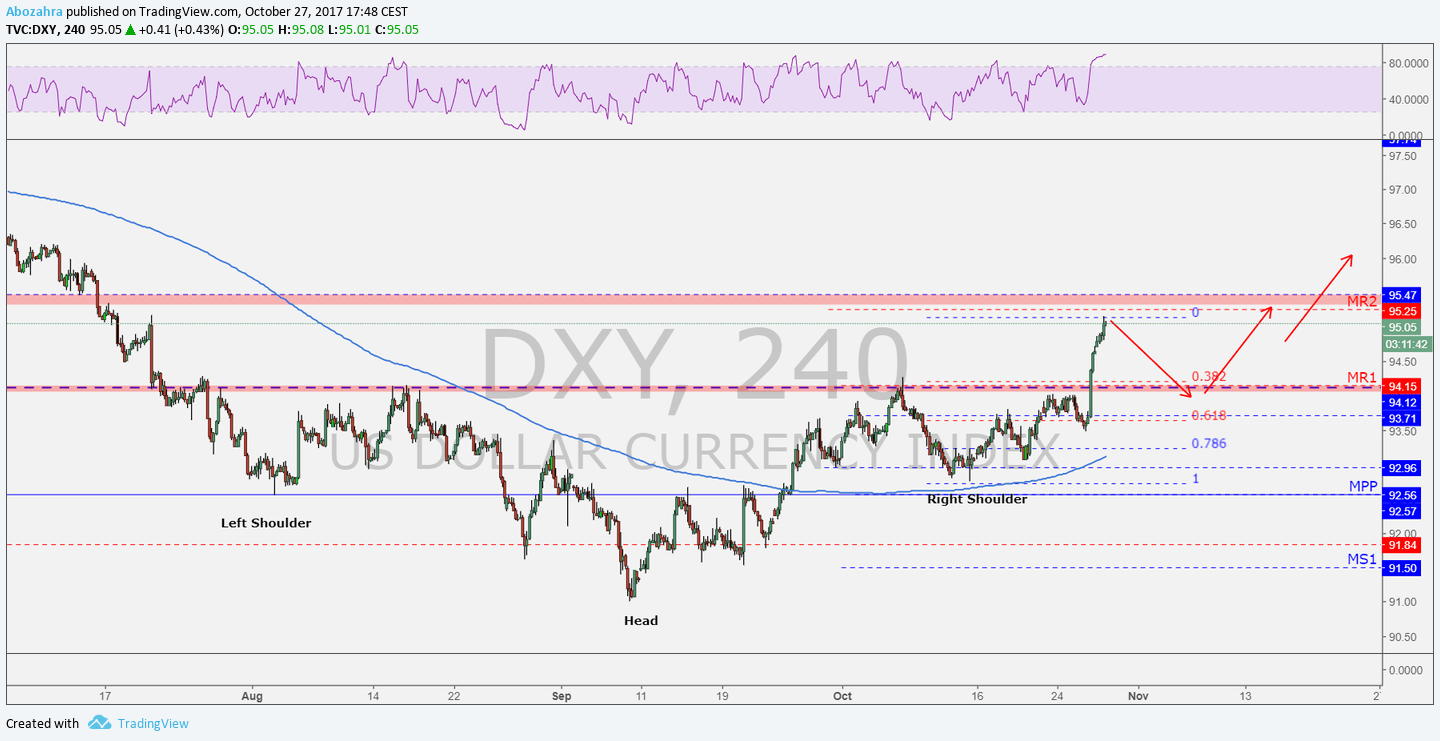

The H&S formation completed and confirmed after the break of the neckline @94,25.

The down trend that started January 2017 is broken. I am looking for bullish continuation from this level and will be looking to buy the pullbacks. First level that we can look at is the possible retest of that broken neckline @94,25, where we also have the 38,2-fib retracement of the last impulse leg.

I personally will be looking for buys only and will not take any counter trend trades against a very strong USD.