The books with the greatest impact on my daytrading are most often books that are not directly related to trading. That is certainly what I have experienced.

This book – The Power of Habbit – has influenced my routines and has created a basic understanding of how habits work and how to change and create new habits. I would definitely recommend everyone to read it because it is super good, interesting and relevant.

As the book’s title suggests, this is a book about habits. The author has read hundreds of pages of academic research and summarized it all into one exciting story.

The book’s length is about 300 pages and there are three main chapters in it.

1) Habits on the personal and individual level.

2) Habits in organizations.

3) Habits in society.

I will briefly scratch the main points from the book, as well as how I have implemented some of the knowledge I have obtained from the book.

What are the components of habits and how are they created?

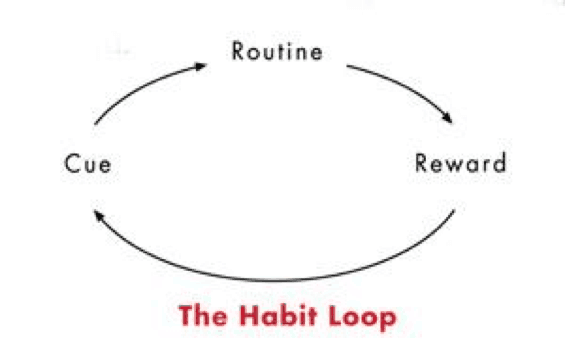

A habit is made up of three things:

1) A Cue (a hint / signal, eg boredom) where you are pointed towards:

2) A routine (ie where you practice the habit, eg biting nails, smoking or exercising).

3) A reward (gain, eg the satisfaction of biting nails, smoking or exercising). If the prize is of a positive nature, then after repetitions of that circle you will create a new habit.

This is basically how a habit works.

“This process within our brains is a three-step loop. First, there is a cue, a trigger that tells your brain to go into automatic mode and which habit to use. Then there is the routine, which can be physical or mental or emotional. Finally, there is a reward, which helps your brain figure out if this particular loop is worth remembering for the future: THE HABIT LOOP” – Charles Duhigg.

However, one thing in this circle is missing to maintain a habit, namely Craving. Cue, Routine and Reward alone are not enough to maintain a habit, here one needs the brain to crave something (the gain).

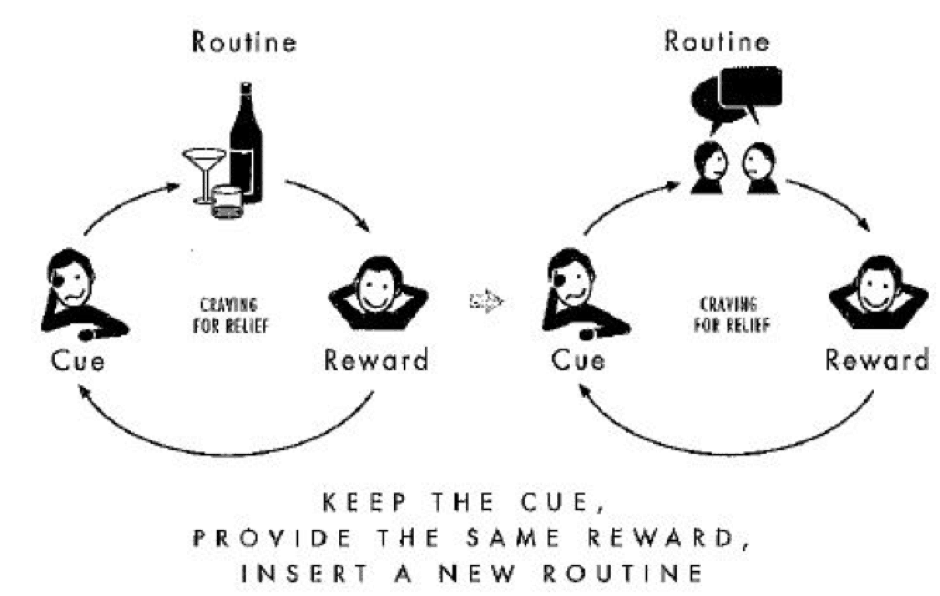

How do we change a (bad) habit?

A habit can not just be forgotten or “deleted” – it needs to be changed. There simply has to be a new routine inserted into the habit circle. As shown in the picture below, you can replace the alcohol (if you have a habit of drinking their sorrows away) with, for example, a therapy group. It’s not to say that changing a habit is easy, but it’s possible. You just need to know what to change.

“The Golden Rule of Habit Change: You can’t extinguish a bad habit; you can only change it.” – Charles Duhigg

Keystone Habits

Another exciting concept from the book is Keystone Habits. A keystone habit is used to improving other parts of one’s life. An example of this is exercise and physical exercise. When you start exercising, you usually start to eat healthier, be more productive, sleep better and so on.

How can we improve our daytrading through habits?

As daytraders, we all have our different habits – both good and bad – and by being aware of the effects of habits, how much they mean, and how to change them, we make it easier to change some of the unwanted habits in our trading. But as far as I can see, it’s more about creating some good habits, such as keeping a good trading journal and reviewing trades. It is mostly boring work and therefore it is important to have a regular routine so you do not forget it. If we were to insert it into our habit circle, it could look like this:

- Cue = Every Sunday at 3:00 pm, an alarm will be reminded that you should remember to enter last week’s trades in your journal.

- Routine = Journaling your trades.

- Reward = After some time of journaling you can see the positive effects of it, such as ways to minimize losses or gain more profit from your winners and see patterns in your daytrading that you might not have discovered without journaling.

I have optimized my morning routine and generally optimized the habits associated with my trading.

Summary on review of “The Power of Habit” by Charles Duhigg

The book is definitely recommended, and as I’ve written, I’ve gained a lot of useful tools by reading it.

In addition to the book, I strongly recommend taking a look at James Clear’s blog, which is one of the only blogs I follow. He writes about some incredibly exciting things, which are always supported by well-documented research.