I was just updating my statistics on one of my mechanical strategies, which is something I do every quarter. This is a strategy that exploits the gap between the closing price on Friday and the opening price on Sunday. The strategy is to go long if there is a gap in a downward direction, assuming that this gap closes relatively quickly as it usually does.

The reason I just want to share the information below with you is that it’s really important to get a strategy backtested in all the markets you’re thinking about trading it in. And with mechanical strategies, this is fairly straightforward. Markets do not behave evenly and the same strategy can perform far differently from market to market.

The strategy here is profitable on 90% of the forex pairs I trade, but there is a big difference between the best performing and the worst performing.

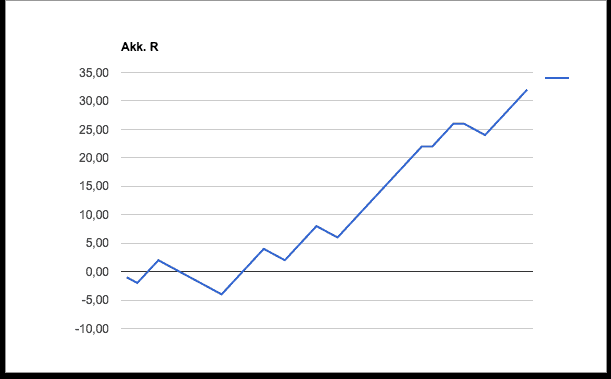

Below we have the accumulated returns in R for the last three years for the market with the highest win rate (I have been trading the strategy for just over half a year live):

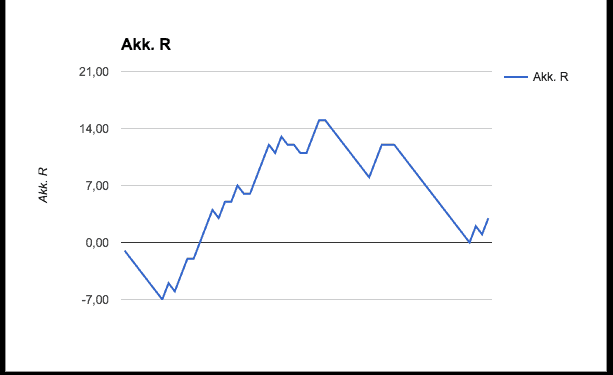

And here we have the one with the lowest winrate:

The returns are even corrected for all trades that did not have a single pip drawdown before the gap is filled. I have done this because my broker opens at 23:05, that is 5 minutes after the official opening hours on Sunday evening. Even though 5 minutes may not sound like too much, yet a significant portion of the win rate will be cut. However, the strategy is still profitable – but again – it’s important to know and take into consideration for these factors.

Summary

But the point with this post is that the very same strategy can perform far differently from market to market. That’s also something I experience in my general trading. Here I can see in my trading journal that I perform better in some markets than others. In the long run, when you have collected data (trades) enough, you can start by sorting out some markets if you can see that it’s not easy to profit in them for your strategy.

Good trading and number crunching!