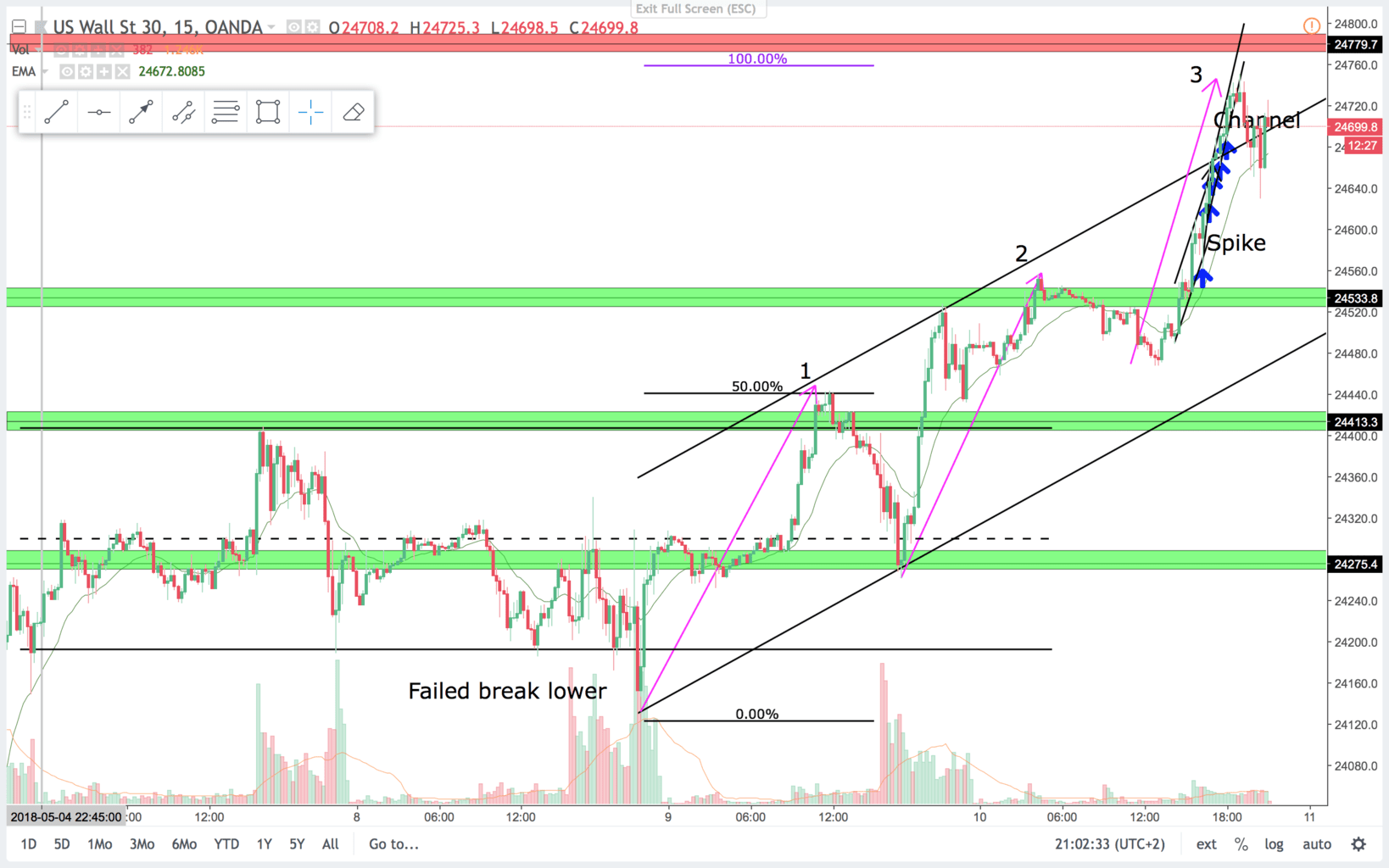

15 min chart:

In the start of this week we had a trading range. Then a failed break lower fueled a break out to the upside. Strong three push pattern up. Now price made a strong spike and channel move up. So market is showing strength this week. Often after a three push pattern you get a correction. Either sideways or down. So how will the next days trading evolve. No one knows, but probability of sideways to up is present. Price is always in long, and I will look to swing my longs and scalp my shorts. Buy be aware, that we could get a correction soon. After a break of the channel line there often is a break of the trend line.

Trades in a strong break out:

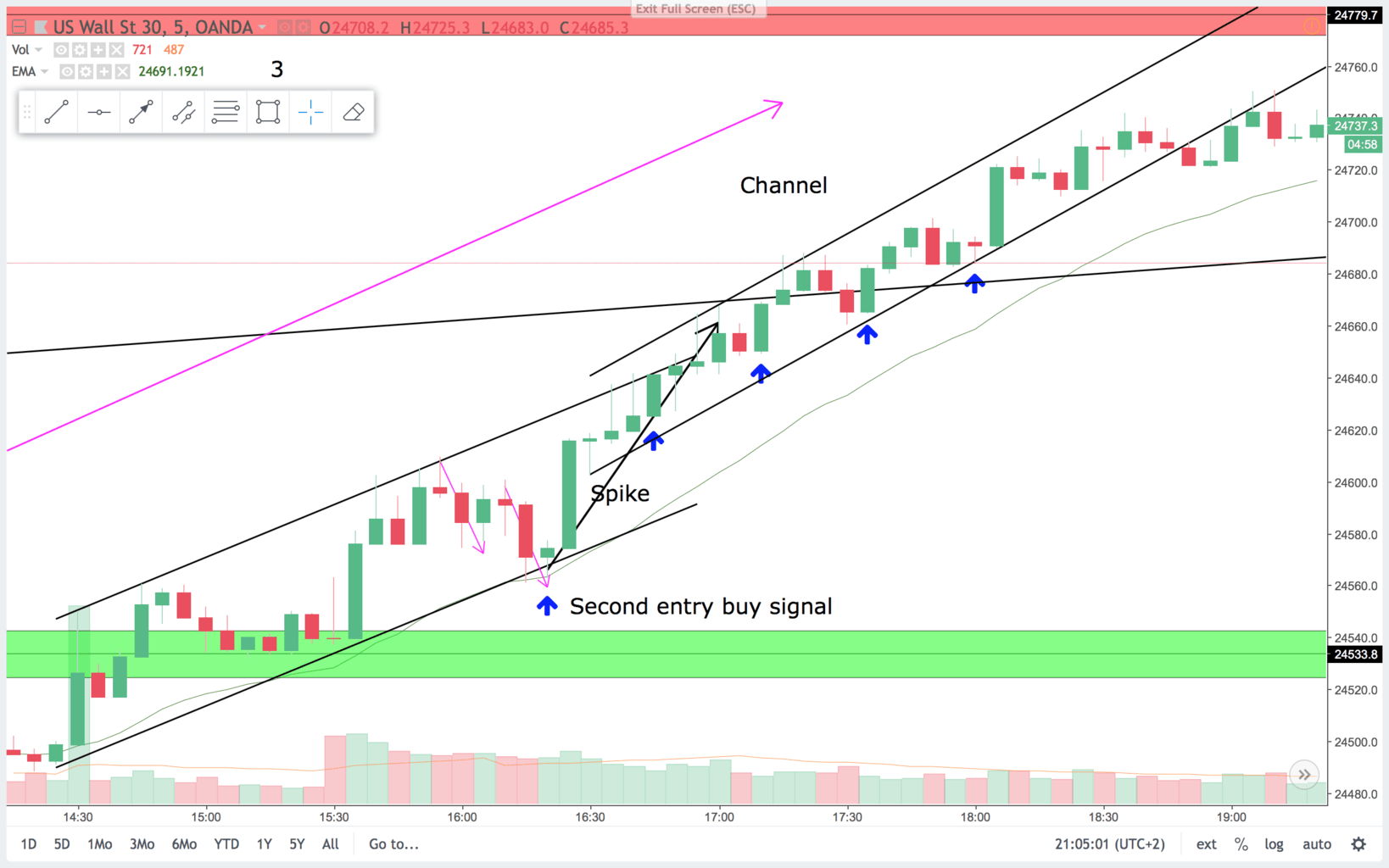

5 min chart:

On the 5 min chart we were trading up in a bull channel. There was a nice second entry long setup on the trend line. That was the trade of the day. Hen price is trending this strong you can buy for any reason. I marked (blue arrows) any signal after a small correction, and that is what I will look for in a context like this. You can take any first entry buy signal. Move your stop up as you get higher lows.

These trend days won´t give you many second entries, so you need to get in the market for any reason.

Have a nice trading week.