Position Sizing

Position Sizing

Position Sizing is unfortunately very undervalued, especially for new daytraders who are often more interested in learning methods and setups.

The method constitutes only one third of a successful daytrader’s strategy, where the two other – and least equally important – are psychology/mindset and risk management. Method is definitely exciting, but in my opinion it’s far from the most important thing to focus on if you want to succeed with your daytrading.

Risk management is alpha omega for a strategy and involves many things. One of the things is position sizing.

Position Sizing is used to control your risk per trade as well as the method of determining the size of individual trades.

There are different ways to determine the position size. For example, you can bet the same amount of contracts on each trade, or you can bet a certain percentage of your capital on each trade. It is the latter method that we will look into in this article.

I learned it the hard way

When I started daytrading, I did not know anything about the terms Risk Management and Position Sizing. It turned out that it was the reason that I ruined my first account. I was – like so many new daytraders – mostly interested in finding the perfect setups and chart patterns. When I finally began to see the need to control my risk, it was already too late. My account was well on its way to zero.

Initially, I traded the same size on all trades, no matter how far my stop-loss was. That made me occasionally risk up to 30% of my trading account in just a single trade. Taking such high risk per trade is a sure way to an empty account no matter how high your win rate is, and no matter how profitable one’s strategy is.

Today, I always risk exactly 1% of my account’s value on a single trade. No more, no less.

Why daytrade with low risk?

There are many good reasons why daytrading with a low risk per trade is the most advantageous for most daytraders.

Losses are limited

Statistics show that 90% of all daytraders lose money at startup. So until you become one of the 10% who actually earn money continuously, it makes sense to lose as little as possible per trade (though not so little it makes no sense). If you risk 1% per trade, it will take you more than 100 losing trades in a row to ruin your account. There is therefore a very low probability that this will happen provided that you have a positive expected value (we write about the expected value in a future article). We show an example later in the article that illustrates this perfectly.

Your psychology will not get affected as much

I have learned that it is much easier to keep your head cool and trade without much emotion when you risk little per trade.

Even more importantly, when a losing streak occurs, the account’s drawdown will be limited. For example, 10 losing trades will result in a total loss of 10% at a risk of 1% per trade. The account will return much more quickly to the starting point and in plus again. Similarly, a 10 streak loss will result in a drawdown of 50% if you risk 5% of your account per trade.

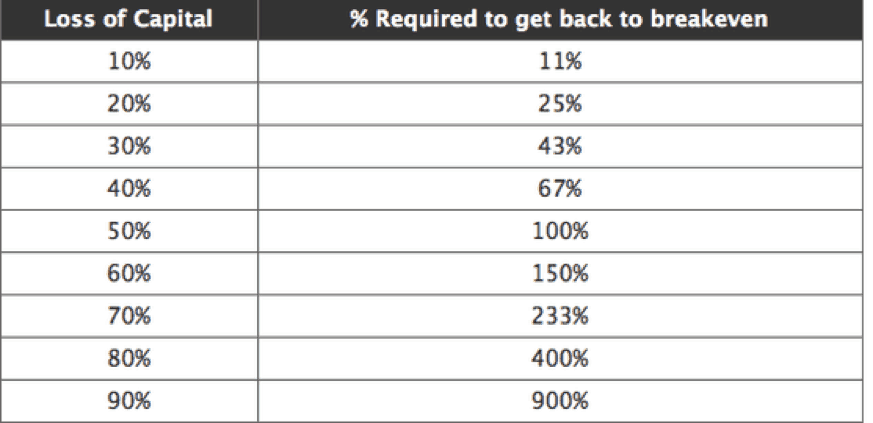

As shown in the table below, it is necessary to earn 100% to return to get back to breakeven.

Once you have lost 90% of your account, the game is over. It will take a really long time to come back to breakeven.

There is thus a long way back to a profitable trading account if you get into a drawdown of 50% and it will definitely affect your psychology and have consequences for you – and probably also for the people around you.

A stable equity curve

Another good reason to trade at low risk is that one’s trading account compared to a high risk profile gets a more stable equity curve with fewer volatile fluctuations.

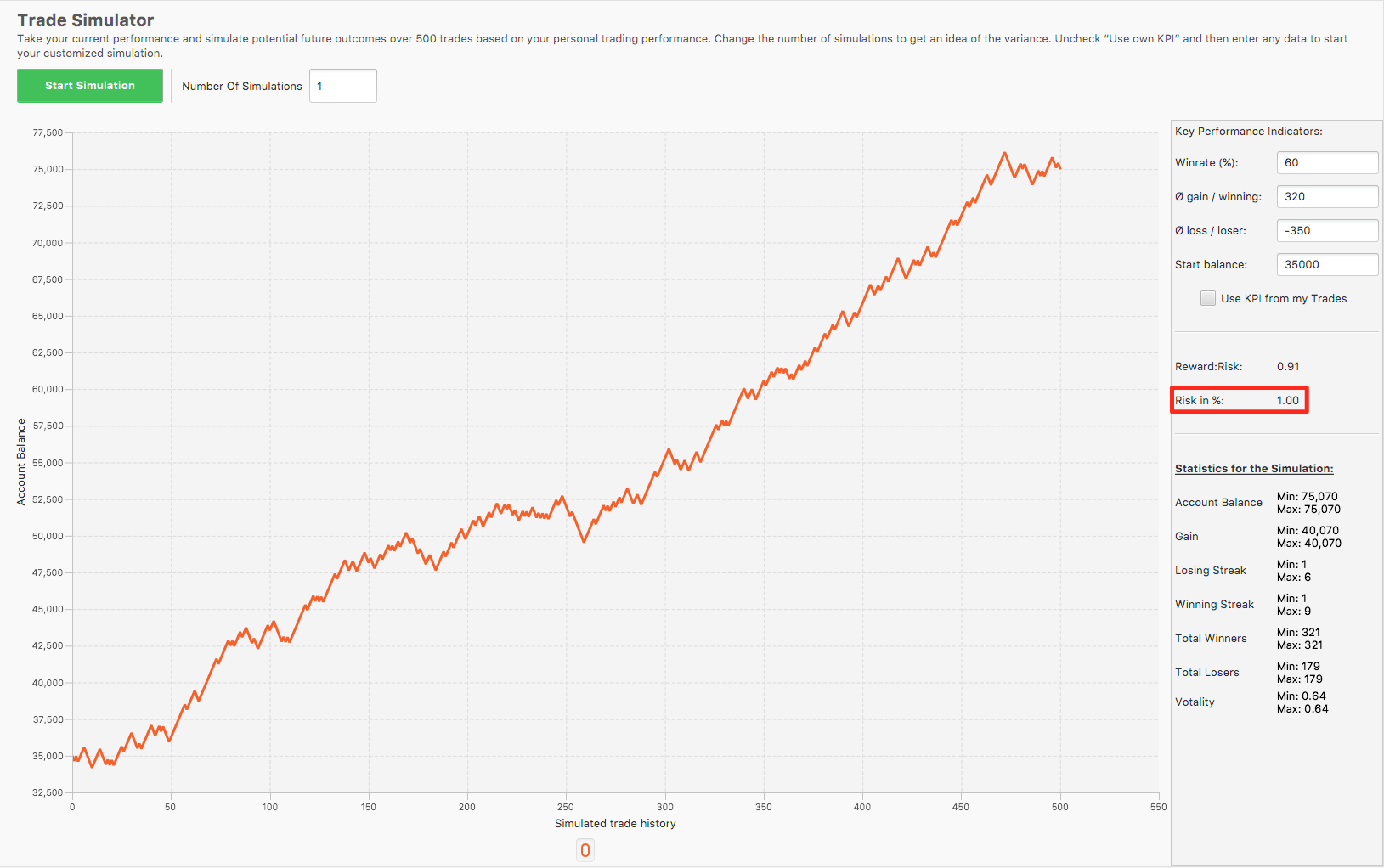

But of course there is potential for earning more money, the more you risk per trade, but the way getting there is also riskier. The following pictures illustrate this very well.

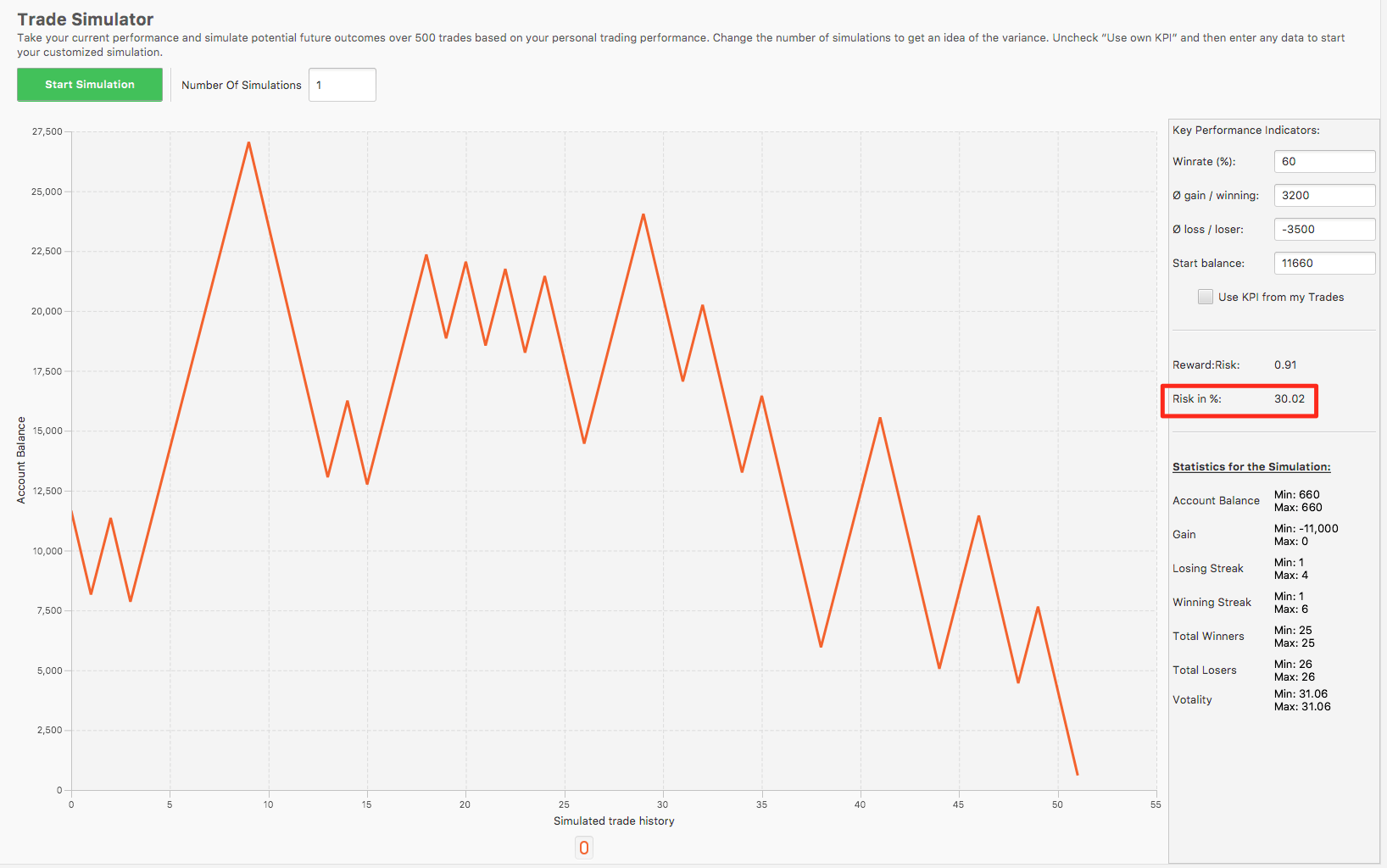

Example of a 30% risk per trade

This is a profitable strategy with a win rate of 60%, which has a positive expected value. The difference between trading defensive and aggressive can thus mean whether a strategy in the long term is profitable or not.

Here is the strategy with a risk of 30% of capital per trade:

Below is the same strategy with a risk of 1% of capital per trade:

The images are from Edgewonk 2.0, which is my trading journal where you can make these simulations with different parameters.

This is the same strategy, just with different risk management.

This is, of course, a bit of an extreme case, starting with a risk of 30% per trade, but it illustrates my point very well. Namely, a profitable strategy with excessively high risk management can easily lose money and quickly ruin one’s trading account.

In addition, there is not a china man’s chance to predict the order of positive and negative trades. Out of 100 trades it is impossible to know when the winning trades come and when the losers come. The probability distribution is often skewed, so it is not necessarily every second or third trade that is a loser. There may be times when you experience eight winners in a row – or vice versa six losers in a row. For this reason, I think it is important not to risk more than 1-2% of one’s account per trade, avoiding excessive negative fluctuations.

How do you Position Size in reality?

In order to find the right position size on the trade you need three pieces of information.

- How much you generally risk per trade in % of the capital (typically 1-2%).

- How far away the stop-loss should be for the given trade.

- How much a point movement is worth in monetary value in the given instrument.

First, you need to find out how much of your capital you are willing to risk per trade. For example, suppose you have a capital of 100,000 kroner and you have defined that you want to bet 1% of the capital per trade. It is then 1,000 kroner per trade (100,000 * 0,01 = 1,000).

The next thing to figure out is how far away one’s stop-loss should be. For example, suppose our stop-loss should be 25 points away.

The last information you must have before you can determine your position size is how much a point is worth. Let’s take two examples.

Dax on a CFD contact

For example, on SpreadMarket a contract of DAX is 1 Euro worth per point. Therefore, we should have converted the currency of the account in euro into Euro. 1,000 kroner is about 135 Euro.

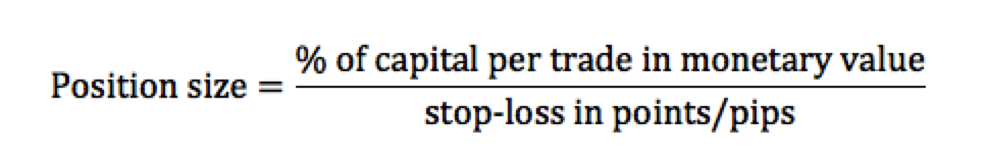

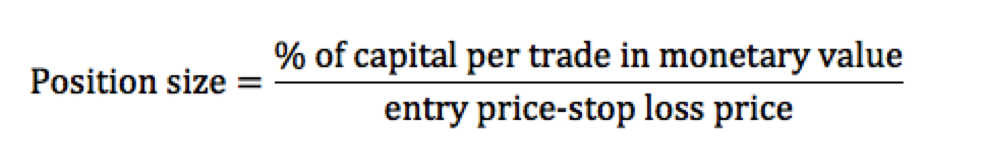

The formula for position sizing looks like this:

In our example, the result will be 135/25 = 5.4 contracts. In addition, one should also remember to recognize the trade cost if you want to be absolutely precise.

Of course, it’s not every time I hit exactly 1% risk, but I try to get as close as possible. With the above formula you should get fairly easily close to the desired risk per trade. The formula applies to most CFD contracts (stock index, commodities) and to all spreadbetting contracts.

Stock trading

It is almost the same approach to trading in shares. Again, we can take the example with an account of 100,000 kroner.

Suppose we would like to buy the ABC share at a price of 20 kroner per share. I still have to risk 1% of the account, ie 1,000 kroner for this trade. I have decided that my stop-loss on the trade must be at price 18. The difference from stock trading to CFD trading is that we have to subtract our entry price with our exit price (stop-loss price).

Now I can calculate my position size as follows:

Which gives:

1,000 / (20-18) = 500 shares.

Do you have questions or comments regarding Position Sizing?

We hope you got something out of this article on the subject risk management with Position Sizing.

Please write below if you have questions or comments.