In our series of platform reviews, we have now come to reviewing the trading platform SpreadMarket.com ![]()

As usual, we rate the platform based on the following criteria:

- Security

- Range of products

- Platforms

- Trading costs

- Charting package

- Customer service

- Demo

- Account- Bonuses

In the end of the article we will give an overall assessment of Spreadmarket based on the above parameters.

About SpreadMarket

SpreadMarket is offered by BUX, which is clearly the market leader in Germany and have more than 210,000 customers spread across 195 countries.

The company was established in 2008 and was in 2013 elected to be one of the world’s 50 leading FinTech companies.

Since then they have repeatedly won numerous international awards.

Security at SpreadMarket

SpreadMarket is licensed in London and is subject to the rigorous restrictions of English FCA, which means that customers are covered by English law in regard to depositor’s guarantee, etc.

An important factor in safety is that they operate with a “no negative account policy“, which means that the customer can never lose more money than the amount in the account. This is an important factor for many traders, since a daytrader often works with high leverage and thus takes excessive risks. This counts very highly in our review that they grant this type of security.

Products from SpreadMarket

Spreadmarket cover the needs of the vast majority of traders.

The user of the platform can find all the necessary products in the following categories:

- Stock indices

- Large shares of all major world stocks

- Commodities

- Forex

- Bond Products-

- ETFs and ETNs

A nice detail demanded by many traders is the ability to trade on the Danish and Swedish stock indices (C20 and S30). This is possible here at SpreadMarket. This gives the opportunity to speculate on the direction, in for example the C20, but also the opportunity to hedge one’s long positions in case of a fall in the Nordic market.

Platforms at SpreadMarket

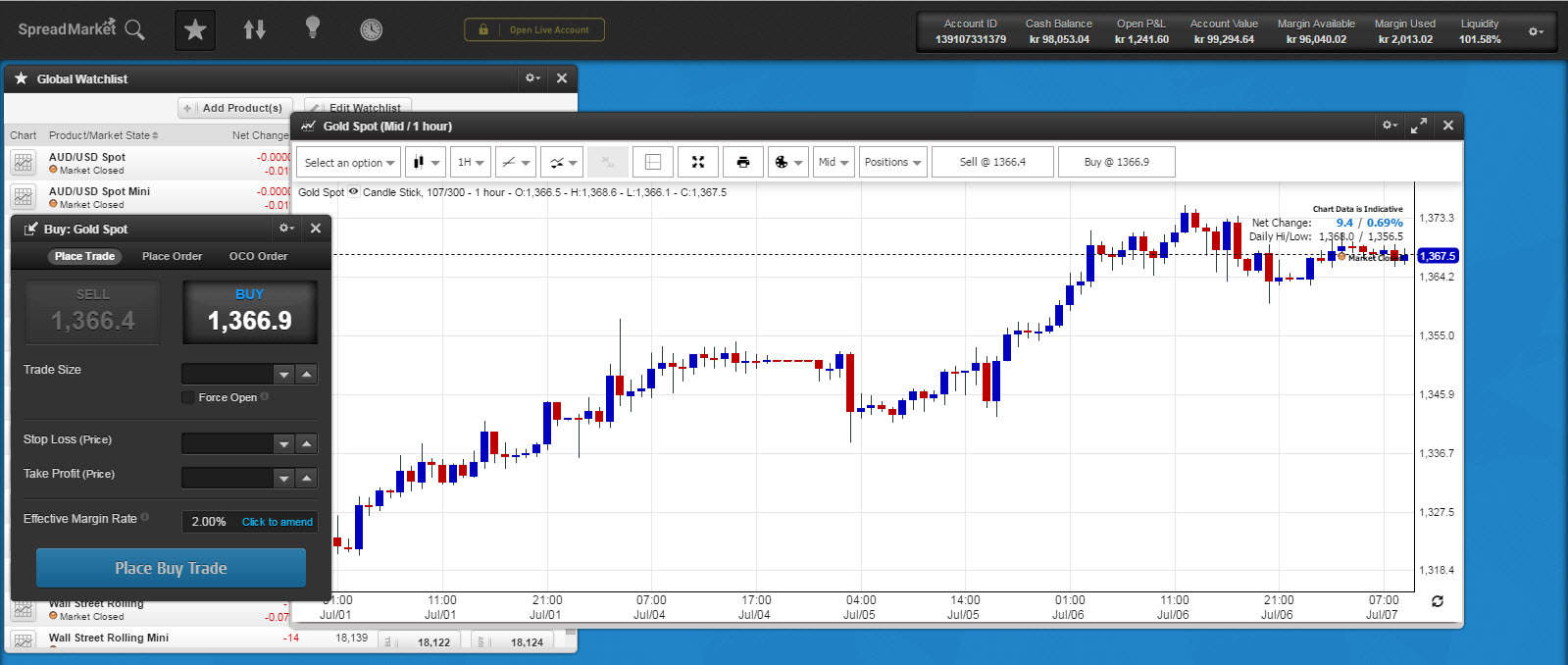

Spreadmarket offers one trading platform, namely their award winning TradeHub, making the approach nice and manageable. The platform supports trading on smartphones and tablets in a professional manner as can be expected of modern trading platforms today.

A simple thing, one might dislike on the platform is that MT4 is not offered by the broker. But unless you want to work with trading robots (known as EA’s), you will not miss this function.

Spreadmarket have recently introduced some very extensive improvements throughout their platform- and graph setup. So far, they had a standard graph package, like most brokers and platforms. But now that they have partnered with NetDania, which many traders know for their quality platform, means that all NetDania’s functions now are now available for SpreadMarket clients. We will cover this in more detail in the section on graph package.

It is possible to select several different languages on the platform, including of course English but also Danish. It provides just the icing on the cake that it is also possible to choose Danish language on the platform.

A product that Spreadmarket not offer is the so-called binary options. Binary options are a speculative product, which in our opinion is very bad to daytrade with. Trading costs are very opaque, and we do not know any serious traders who uses and make money on binary options. Many brokers choose to offer binary options because they have been very popular, especially among new traders.

The fact that Spreadmarket opted out the possibility of binary options, is in our opinion actually a sign of a serious broker.

Trading costs at SpreadMarket

SpreadMarket offers trading with CFD contracts, which is very similar to spread-betting. CFD is just traded in certain sizes determined by the size of the CFD contract. SpreadMarket is working with so-called fixed spreads. This means that spreads are fixed around the clock. We have been in and tested several times of the day, and the fixed spreads are indeed fixed.

DAX: 1 point

DOW: 2 points

EUR / USD: 0.8 pip

USD / JPY: 1.5 pip

AUD / USD: 1.5 pip

Oil: 5 points

Gold: 5 points

Charting package at SpreadMarket

As mentioned earlier, the graph package at Spreadmarket bought in from NetDania, is working very well.

For the experienced trader, there will not be much to point fingers at.

There are all the most popular chart types such as:

- Candlesticks

- Barchart

- Line Chart

- Heikin-Ashi

- Renko

- Etc.

All the popular drawing tools are also available to users such as Fibonacci lines, Fibonacci fans Fibonacci time zones, etc.

An important area to examine in a test like this is if the range of technical analysis tools is satisfactory.

Here comes the NetDania platform seriously into power.

I have counted that they have a total of 175 technical indicators! There is simply everything a technical analyst may need.

Throughout my many years of investment and trading I have tested a variety of indicators. I can immediately find them all in the list of indicators at Spreadmarket. I must admit that there actually are at least 10 to 20 indicators that I have never even heard of.

The graphic platform is very clear and it is easy to place orders, correct them, change the stop-loss, take profit and so on. A simple deficiency that can be pointed out here is that it is not yet possible to do so-called Trailing Stop losses. But we know that they are working on it, and it be available shortly.

A really nice function at SpreadMarket is that the stop-loss on almost all products are guaranteed – even without additional cost.

This means that when one has left in the Stop-loss at such a distance that produces a small “G”, you will be stopped out at that price regardless of how the market behave. This makes it safer to hold positions outside market hours, as even large gaps between trading days are not going to have any effect. It is far from all brokers that offer the guaranteed stop-loss, and those who offer it, usually make themselves very well paid for this. At SpreadMarket, this feature is offered for free.

There is one drawback of the graph package, which we miss greatly. It is the ability to draw chart windows to other screens if you work with more than one monitor. But in our contact with the broker, we have been told that they are working on it, and that the developers will soon have this feature ready.

Customer service at SpreadMarket

As a start, customer service is offered in English on the phone and by e-mail, but there is also the possibility for Danish support.

Our contact with the support has been very satisfactory.

Demo Account with SpreadMarket

SpreadMarket – as most other brokers – offers the ability to try the platform on a so-called demo account where you can trade for paper money. This is an excellent opportunity to test the platform of, so you are sure of the various functions before you start with real money.

SpreadMarket offers a 40-day demo account. This is in our view more than enough to put one firmly into the intuitive easy platform from SpreadMarket. But if you need more, then it can always be renewed for free.

Bonuses at SpreadMarket

As with the binary options we mentioned earlier, we consider the bonuses of a broker as a negative sign. Of course, these bonuses can be used advantageously by good and experienced traders who switch brokers often. But there are always certain revenue requirements and a lot of demands that must be met. This is of course in place to ensure that people get started to trade. However, these bonuses often result in new traders trade way too often.

So we see it as a positive sign that SpreadMarket opted out bonuses to new customers.

Overall rating of SpreadMarket

Overall rating of SpreadMarket

- Safety – 5 points

- Range of products – 4.5 points

- Trading platform – 4.5 points

- Trading costs – 4 points

- Charting package – 4.5 points

- Customer service – 5 points

- Demo Account – 5 points

- Bonus – 5 points

Overall Rating: 4.7 out of 5.0

SpreadMarket have clearly been the best platform we’ve tested to date. They have scored a mark of 4 or higher on all of the eight criteria in our review. The only criticism of SpreadMarket is that they do not offer the MT4 platform. It counts a lot in our review that the customer can not lose more than their account balance, and that they are offered free guaranteed stop-losses as well as an innovative and intuitive trading platform.

Disclaimer: All reviews and opinions in this article are as objective as possible and are not produced in cooperation with SpreadMarket. SpreadMarket is after this review advertiser with DaytraderLand.com and pay commission to the writer if you sign up to the SpreadMarket trading platform through the above affiliate link. SpreadMarket also sponsors our webinars about market analysis.

Comments about the review

What are your personal experiences with SpreadMarket?