In this article I will describe a method that I have been very successful with and constantly working on improving and refining further.

I have previously written an article about the use of different time frames when you daytrade. If you have not read it yet, I recommend that you read it before reading this article to get the most out of this article.

An important point in the article above is that you use the higher timeframe to find the general trend and then use the smaller timeframe for timing the trades.

Use of timeframes in the 5/1 method

I use different timeframes in combination, both in my ordinary equity investments, in my slightly shorter swingtrading and in the very short term daytrading on a daily basis.

When I use the 5/1 method, it is 5-minute and 1-minute charts that I’m looking at. I’m using the 5-min chart to evaluate the direction I should trade of. The 1-min. chart is my timing chart that tells me when to enter the trade.

Let me concretize this with an example.

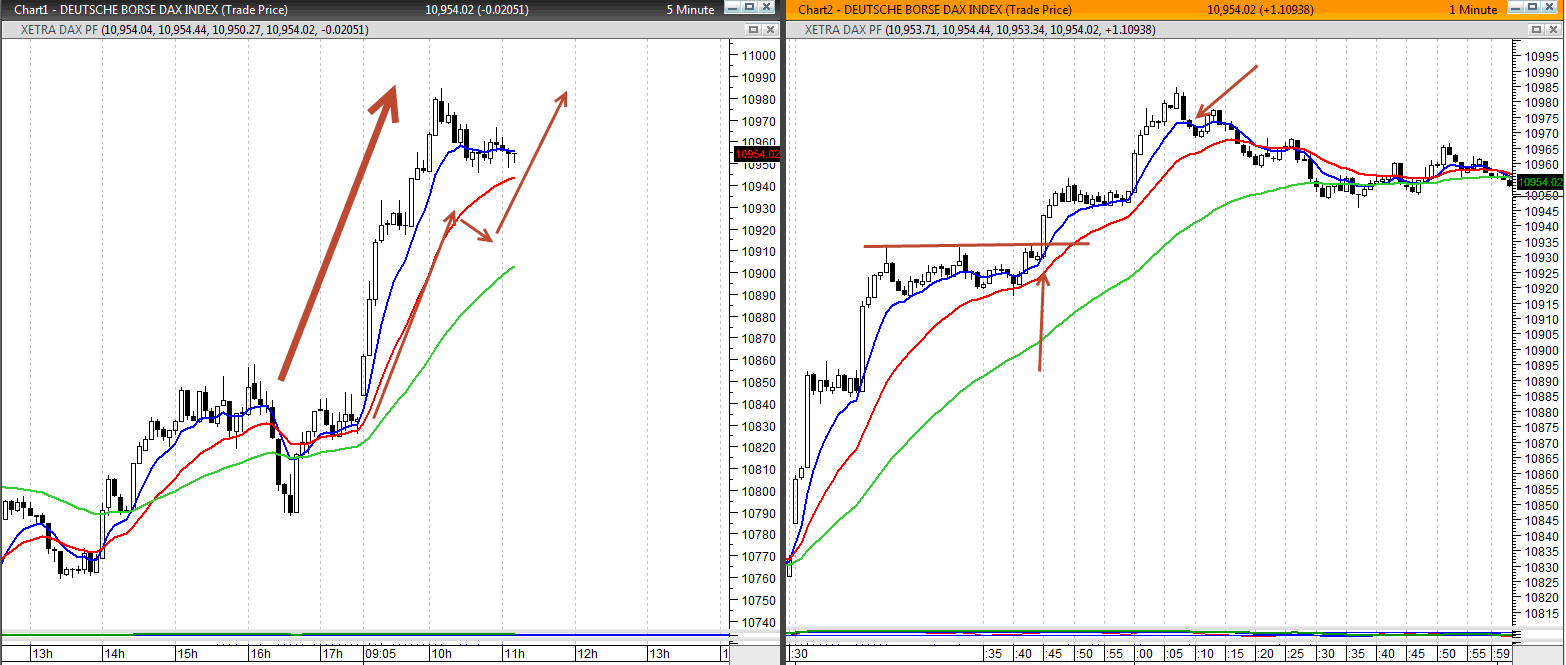

Above to the left is my 5-min chart. Three moving averages have been added to the chart. It is an 8-period, 20-period and 50-period exponentially moving average.

I use the 5-min chart to see the overall trend in the market (reflected by the big thick red arrow in the chart on the left). You can see how, with thin red arrows, I have shown that the great trend is built up by smaller rising waves.

The right timing with the 1-min chart

I await a pause in the trend of the 5-min chart and then use my 1-min chart to accurately time the trade.

In the example above to the right, I go long (I bet on a continuation of the trend), as I see a break of a double top on the 1-min chart from earlier, while the moving averages on both my 5-min and 1-min chart point well up.

Does this method work?

This is a so-called high probability setup; A setup with high likelihood of gain.

It may take a few hours or maybe half a day when I can not get a proper signal. But when they come, I’m successful with it for about 75% of cases. When I win, the trade usually captures between 20-50 pt., Even sometimes up to 100-150 pt. In the DAX index, while losses are usually only in the range of 8-20 pt.

So it’s an excellent setup for the patient and disciplined daytrader.

Here you will see a video explaining the method in more detail.

Although I unfortunately do not have time to trade every single day, the above method is the primary reason why I made 134.7% return on my daytrading in 2015.

You can also learn that.

I will continuously update this article, so bookmark the page and visit it again soon.

Do you have any questions regarding the 5/1 method?

If you have questions, do not hesitate. Ask below.