In this article we will look at the popular indicator Volume Weighted Average Price (VWAP).

The indicator can be advantageously used for mean reversion trading, which we know from Bollinger Bands. The indicator is used on the smaller timeframes which makes it ideal for daytrading.

How the VWAP is calculated

VWAP is calculated cumulatively from the market open to the close (on DAX, that is from 08-22). It starts calculating again the next day. This means that it gives a more accurate view of the average price for the day in contrast to the standard moving average that includes data from previous days. However, you do need to take into consideration that because of the cumulative calculation the VWAP is more sensitive at the open than it is at the close.

The indicator calculates the average price by including the volume in the equation in a weighted average. Personally I like that it is based on volume, as I am a bit sceptical of why it should be the 200 period moving average instead of the, say, 89 period. With VWAP you don’t have to consider this problem.

Let us take an example to get a better understanding of the calculation.

| Price | Volume |

| 50,00 | 53 |

| 50,10 | 65 |

| 50,25 | 14 |

| 49,80 | 169 |

| 49,25 | 240 |

The average price after 5 periods is 49,88.

To get the VWAP, each price is multiplied with volume and added up and then divided with the total volume to get a weighted average. The result is 49,62.

Notice that the VWAP is significantly lower than the average price, which is because of the high volume at the price 49,25.

What can the VWAP be used for?

Several of the big players in the market uses VWAP as a benchmark for their execution of their trades. They typically want a buy price that is below VWAP and a sell price that is above VWAP. From the calculation, we can now understand why institutions are using VWAP to execute their trades and why private investors use it as a dynamic support and resistance area.

VWAP shows the most liquid area of the day. To know this area can have a big impact on your daytrading

Additionally, the indicator can be used as a filter for long and short trades. So that you don’t enter a long trade if the price is far above VWAP, and vice-versa for when shorting, you don’t enter a short trade when the price is far below VWAP.

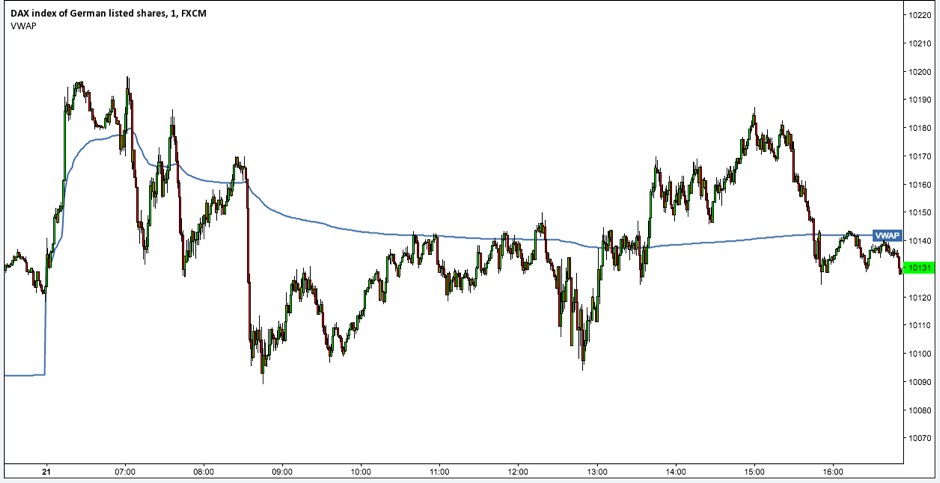

On the picture below is DAX on a 1-minute timeframe with VWAP as the blue line.

You can see clearly how the indicator is moving rapidly at the open and then stabilize around the close. Price respects VWAP – especially around lunch-time.

Follow the trend

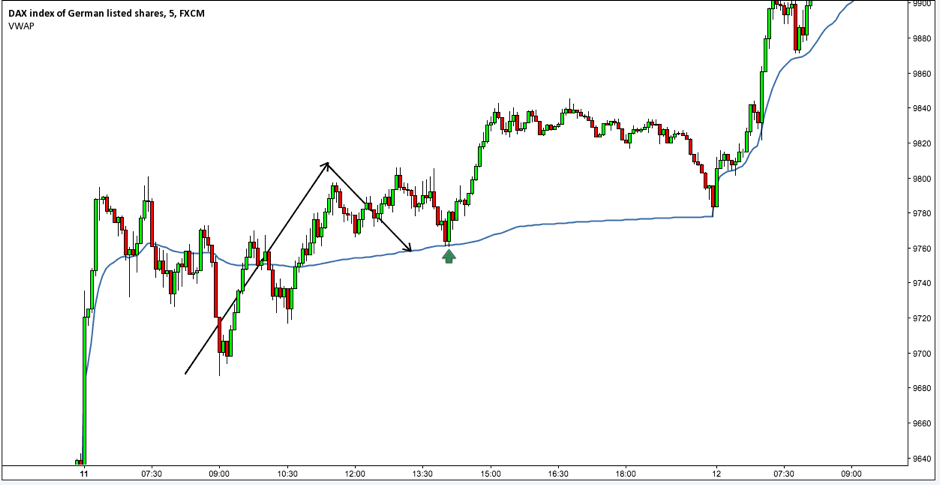

The number of strategies based on VWAP is relatively limited. Most daytraders use the indicator as a filter or guideline. However, you can try to trade the first retracement after a breakout back to the VWAP and with the trend as shown in the picture below.

I personally use the indicator for extra confirmation on setups. That means that if there is a support and resistance area around VWAP, I am more aware of trading.

Mean Reversion

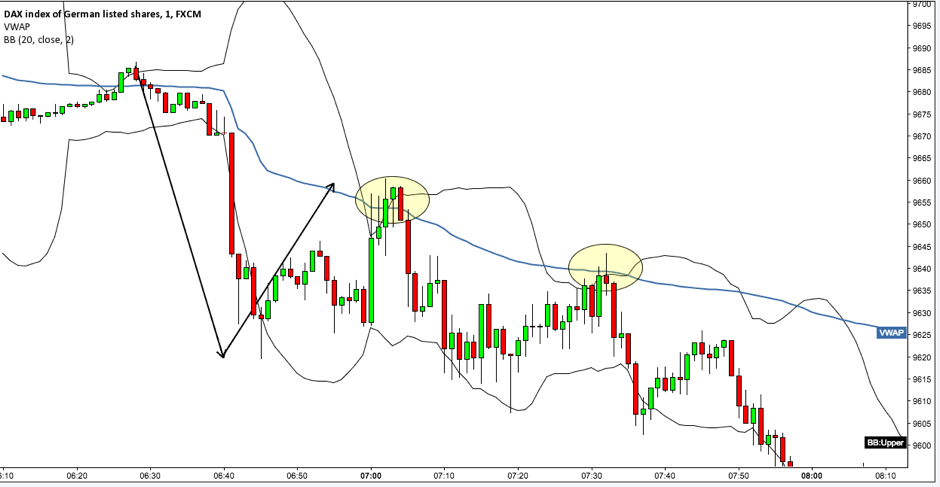

You can, as discussed previously, combine the VWAP with a mean reversion strategy, where you trade a retracement back to VWAP and a close outside Bollinger Bands. The rational behind this strategy is that the price has moved too far away from its’ standard deviation while it hits a high volume area with a lot of transacted trades. This gives a strong potential reversal area as seen in the picture below.

The VWAP indicator can be found on www.Tradingview.com by searching for VWAP under indicators.

Read more about VWAP

You can use VWAP in a lot of different ways in relation to your own strategy. For more information about the use of VWAP, you can listen to this podcast with Zach Hurwitz, who perfected his VWAP strategy in the last two years. Like anything else it takes time before you master one strategy, which Zach also points out in the podcast. He himself searched after the holy grail and found VWAP. He could understand the logic behind trading the most liquid point of the day – and has not looked back since.

Questions and comments for VWAP?

We hope that you gained something from this article. If you have any questions or comments, please post them below the article here.