This article is a follow-up to our first article on Social Trading at SpreadMarket, so we recommend that you first read the article to become familiar with the concept as well as its pros and cons.

Social Trading – also called Copy Trading – is becoming increasingly popular in Denmark among skilled daytraders who want to make money investing other people’s money, as well as individuals and companies who want a much higher return than what the banks can offer.

As described in the first article about the Social Trading concept, the concept has many advantages and a few drawbacks. Following skilled daytraders with a solid performance over a longer period of time saves you time in front of the screen while diversifying risk and also likely to get a far higher return on your capital than oneself could create.

In this article, we will look into how to get started with Social Trading and how to choose which daytraders to follow.

Get access to Social Trading

To get started with Social Trading, you need to have an account with SpreadMarket. It is completely free and non-binding.

You can create an account through this form and then submit an electronic copy of your passport as well as documentation for your address. If you are fast – and a bit lucky – your application will be approved within a day.

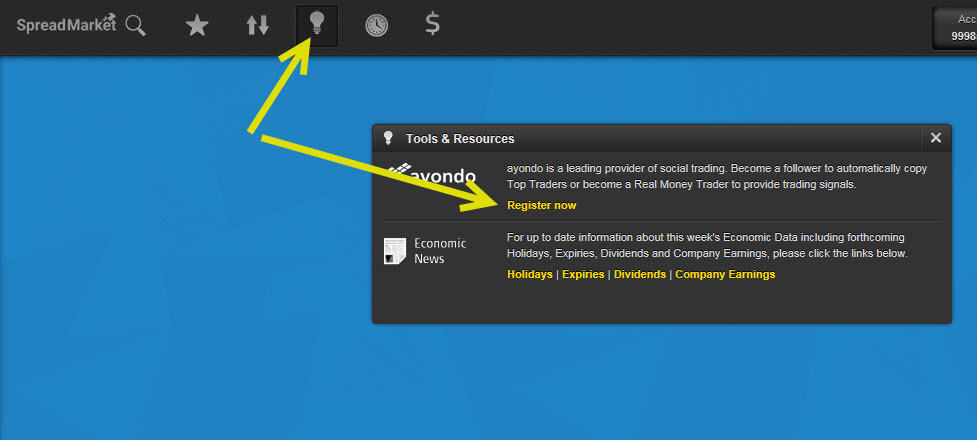

Once approved as a SpreadMarket customer, just login to your profile and press the lightbulb icon in the top menu and select “Register Now“. Then all your information is automatically retracted on the Social Trading platform.

Then create and select your account type. You can choose either to be a “Follower” or a “Toptrader“. Follower means you would like to copy the trades of other traders.

Choosing a TopTrader

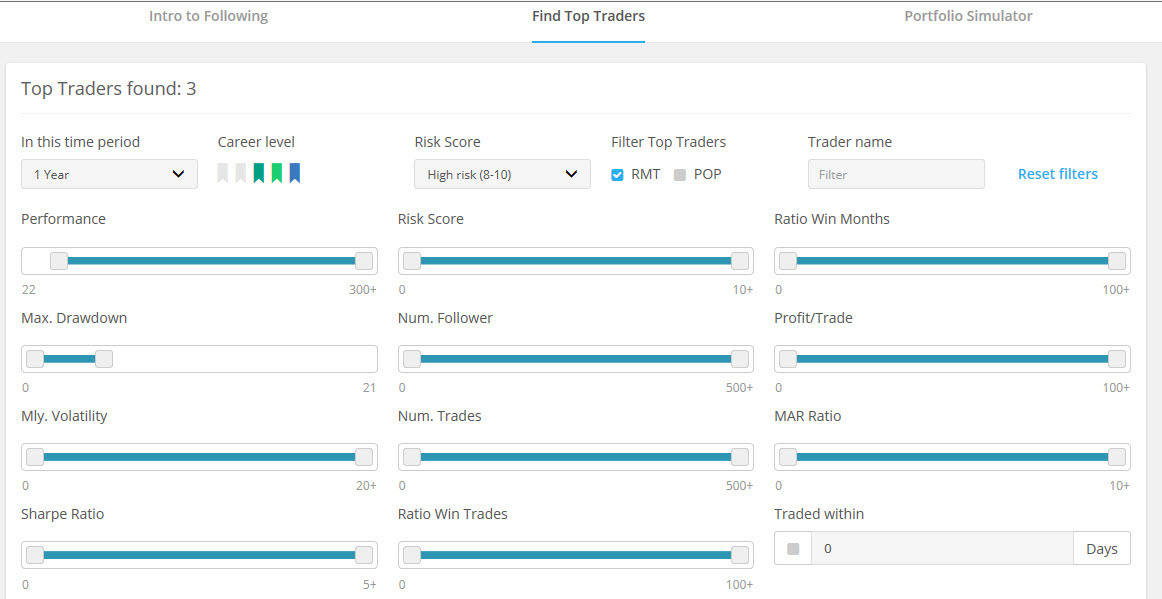

You can find toptraders by clicking the menu item “Find Top Traders”. It brings you to the search page where you can set your desired criteria for the people you want to follow.

The search page looks like this.

Let’s review the possibilities one at a time.

In this time period

Here you can choose how long time back you want to see statistics for. In general, it is recommended that you choose at least one year’s history in each two rows, as you would like to have as much information as possible to make a robust decision.

Career level

These small flags illustrate how many requirements each individual toptrader has met in the system.

To reach level 5 – the highest level – a toptrader must have traded in the system for at least one year with a positive return and had very limited losses along the way. You can read more about the importance of each flag on the website.

The classification ensures that it is a skilled trader who is able to produce positive results over the longer term and thus has not only been lucky for a month or two.

As a starting point, we recommend choosing toptraders from levels 3 to 5 to ensure a certain level of performance performance.

Risk score

The SpreadMarkt Social Trading platform divides the top traders into different risk categories depending on their win-rate, draw-down, etc. Here you can choose between a risk score of 1-4, 5-7 or 8-10. Note that risk and return are generally correlated (lower risk = lower return). So if you choose level 1-4, then there are more traders to choose from. They may have a lower return, but also a significantly lower risk.

RMT / POP

RMT stands for “Real Money Trader“, which means that traders not trade on a demo account, but actually trade their own money. We recommend that you choose to copy traders who actually trade for real funds as they usually take it more seriously.

POP is a search filter where you will find the most popular traders if you want to see what others have chosen.

Trader name

Here you can choose to search for a specific trader if you already know the name of a top trader you wish to follow.

Further search criteria

Under these first selection criteria you will find a large number of “sliders” where you can define more precisely what you want to search for. Here you can choose to specify minimum return, risk score, number of winning months, maximum drawdown, number of followers, profit per trade, number of trades per month and more.

An example of choosing a toptrader

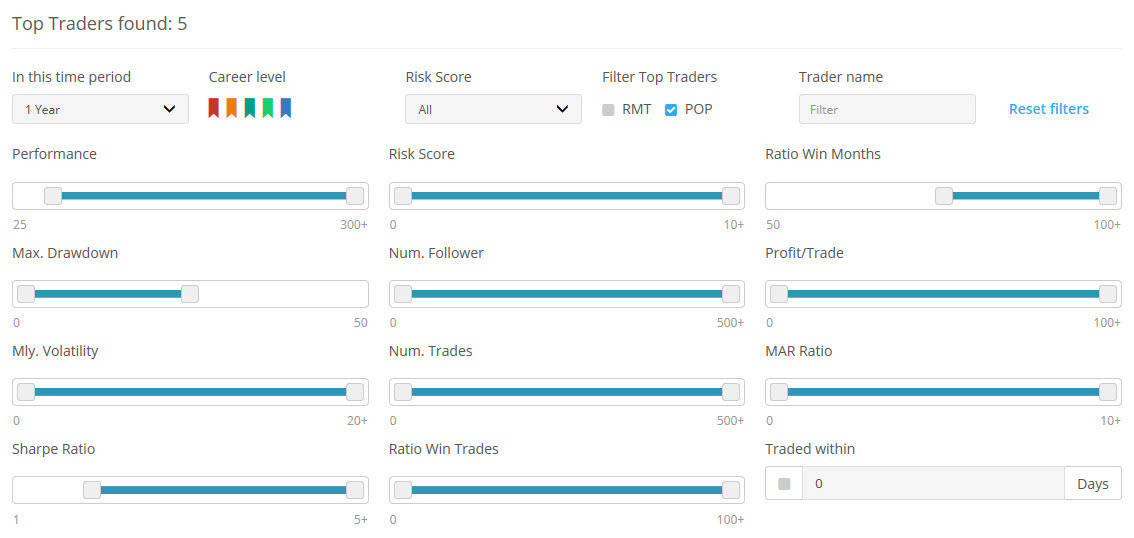

Below is an example of a search where we have selected a number of criteria at the slightly riskier end, allowing for a high draw-down, high monthly fluctuations (volatility) and more.

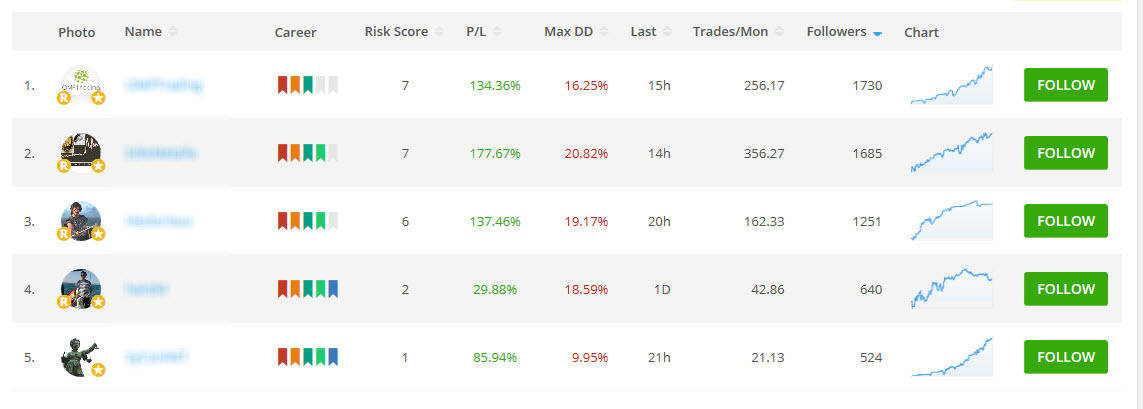

The search result gives the following toptraders.

You can press on to the profile of each Toptrader if you want to know more about him.

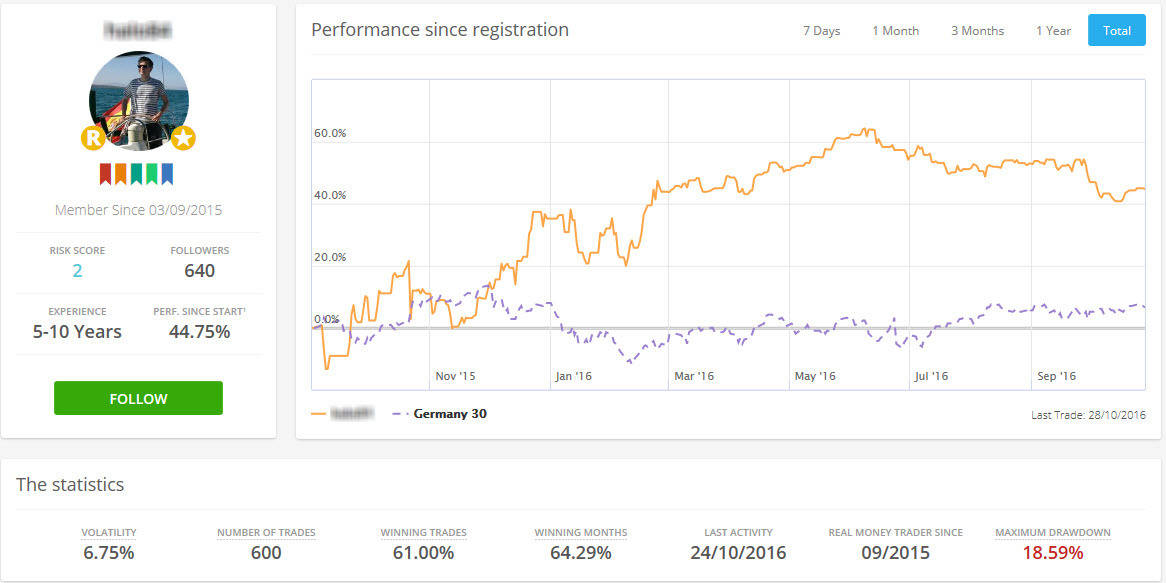

Below is the number 4 from the list above. He has career level 5, a risk score of 2, a profit of approx. 30% per year return, a draw-down of -18.59% and approx. 43 trades per month.

The profile gives access to further information. We can see his total equity curve and the development in this. We can see that he has a risk score of 2, has 640 followers, and has earned 44.75% since the start about a year ago, etc.

In this way we can go into each top row and evaluate if we think his performance is acceptable and fits our selection criteria.

Once we have reviewed all the selected top trades and approved them, we can either press “Follow” next to each of them or initially create a demo portfolio where we follow them over time without giving them real money to trade for.

Demo portfolio

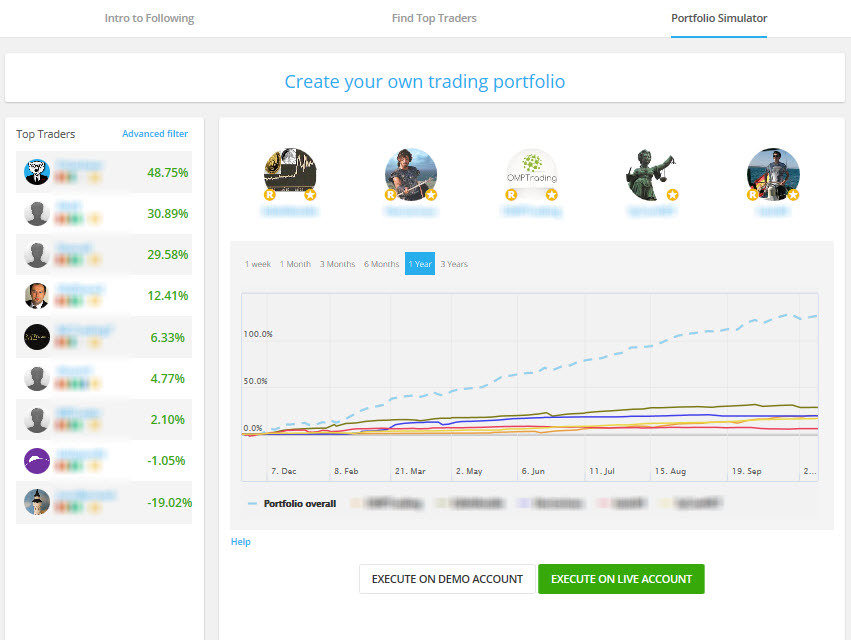

Below is how we have collected the five selected toptraders to track their overall performance.

The bottom lines of the chart illustrate the development of each toptrader, and the blue dotted line is the portfolio’s overall performance over the past year. As you can see, this portfolio has made an impressive return of over 100% in one year. This is because we have chosen some relatively risky traders.

Now, we can choose to select this portfolio on a demo account or enable it on your live account (the green button at the bottom right).

Diversifying risk with Social Trading

Diversifying risk is always a good thing.

Within social trading, you can spread your risk by selecting multiple top players (up to five) as well as picking top traders trading in different markets. The latter means that your portfolio does not have a large exposure in the same market.

In the example above, the overall chart shows that our mix of toptraders complements each other sensibly. For although they each have had drawdowns in the portfolio between 10-20%, the total portfolio does not show any significant drawdowns indicating that everyone has lost money at the same time.

Summary on Social Trading

Social trading has come to stay. It creates contact between the most experienced daytraders who want to make money investing other people’s money without having to go through a lot of unnecessary administrative processes and people who want a passive return on their money but still want to influence the portfolio’s composition.

If you have questions about social trading, write a comment below.