Forex – or simply called FX – is the most traded markets for daytrading and swingtrading.

Forex is a shortage of Foreign Exchange and covers the market where you can trade currencies against each other.

Forex is traded decentrally

A particular feature of Forex is that you trade it Over-The-Counter (OTC). OTC is used as a description of a financial market that is not traded on a real central market exchange.

The foreign exchange market does not have a central market exchange but is traded through a network of dealers that are connected electronically worldwide. This means that Forex can be traded actively 24 hours a day 5 days a week, as there is always a financial market open where dealers quote prices on the currencies.

Currency transactions are made around the world millions of times each day. This makes the Forex a gigantic and very liquid market compared to the other financial markets.

Currencies are traded in pairs

Another special feature of Forex is that you not only trade one currency, such as when you buy or sell stocks. If I buy one share at a price of 100, I’m long the share, hoping that the price will rise. But for currencies, it’s something different. Here you always trade a so-called currency pair where you trade one currency against another.

Such a currency pair could, for example, be:

Euro / US Dollar

British Pound / Japanese Yen

When you name these currency pairs, you always describe them as abbreviations, so the above is called:

EURUSD

GBPJPY

Trading currency pairs mean that you are always long in one currency and short in the other.

How is the price of a currency pair quoted?

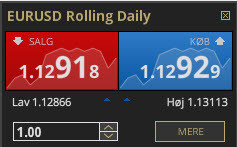

When a currency pair is to be quoted, it looks like this as on here at EURUSD

When quoting the price of a currency pair, the first currency (here EUR) is the base currency and the other currency (here USD) is called the counter currency.

A price as in the example above indicates how many units of the counter currency we get for 1 unit of the base currency. In this specific example, we can buy 1.12929 US Dollars for 1 Euro. As with any other trading, it is quoted as two prices. One price indicates what you can sell for and the other price indicates what you can buy. This shows the pricing as 1.12918 / 1.12929.

Since currencies are not so volatile, the price does not fluctuate quite so much a day, measured in percentages. Therefore, currency pairs are generally quoted down to fourth or fifth decimal, which is completely different than, for example, stock trading, where you always trade them in whole dollars and pennies (for example, 125.50). In this case, it’s the two big numbers 91/92 or 291/292 we have to look at to assess what we are earning on a move.

A movement in EURUSD from 291/292 to 292/293 is called an increase of 1 pip.

Pros and Cons of Trading Forex

There are many advantages to daytrade forex instead of index and shares.

It can be aligned with your everyday life

As I said, the Forex market is incredibly liquid. This means that there is a good opportunity for trading for very large amounts at all times of the day five days a week. This relationship means that you have far greater opportunities to customize your daytrading into your normal life with work, family, hobbies, etc.

Lower trading costs for forex trading

Since the market is so large and liquid, it is possible to trade with low costs. With the vast majority of brokers today, you can trade the biggest currency pairs with a spread of just 0,8-1,5 points.

Daytrading in forex can be geared highly

Another feature of the Forex market is the great potential for heavy leverage.

Depending on your choice of broker and currency pair, you can trade in the Forex market from a factor of 50: 1 and up to a factor of 400: 1. This means that you can only have to deposit a very small amount of your own money to trade a very large currency position with.

Specifically, it means that with a 400: 1 gearing and just 250 USD in your account can trade a 100,000 USD in the foreign exchange market. It opens up for some unique opportunities to earn – and also lose – a lot of money. If you have managed your money by 400: 1 and have read the market correctly, an increase of just 1% in your position from 100,000 to $ 101,000 can yield a return on your capital by 400%. But, conversely, there is only a decrease of 0.25% needed before your entire capital has disappeared.

This opportunity to gear heavily can easily be an advantage in daytrading, but it requires a high degree of discipline and risk management, so you do not suddenly experience multiple months’ profits on the trading account diseappear into smoke because of a fast and unforeseen move in the market.

The most liquid currency pairs

If you choose to go ahead with daytrading or swingtrading in Forex, you can start with any single currency pair on the market. But we would recommend you to start out with the most liquid pairs:

– EUR / USD (Euro / US Dollar)

– USD / JPY (US Dollar / Japanese Yen)

– GBP / USD (English Pound / US Dollar)

– AUD / USD (Australian Dollar / US Dollar)

– USD / CAD (US Dollar / Canadian Dollar)

– EUR / JPY (Euro / Japanese Yen)

You can easily choose more currency pairs, but as a starting point, it’s always advisable to start with a few markets that you first learn.

Video

Here is a video that summarizes the article and comes with a few extra points.