The word algorithmic trading – also called algo trading in daily talk – has increasingly begun to become part of many daytraders vocabulary and is often a debate.

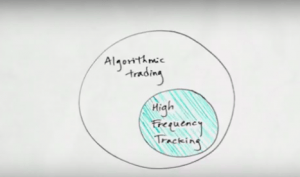

Algorithmic trading is defined by the fact that trades are done by a computer based on a determined mathematical calculation.

The few are aware of how fast supercomputers actually perform algorithmic trading in the professional markets and the spread of their use. In the US, 65% of all trades is placed by algorithms.

Whether you use algorithmic trading or not in your daytrading, it’s important to understand how one of the biggest forces in the market operates. Here is the physicist Sean Gourley’s video below an excellent place to start.

Sean Gourley’s video below describes the recent years of development in mathematical algorithms in daytrading with algorithmic trading, on the internet and in our physical everyday lives. In the section on algorithmic trading, we get an exciting insight into why the analytical capabilities of the computer hit the human by lengths due to their response times in milliseconds and see examples of different methods that the computer uses to beat the market.

In addition, Sean Gourley describes a well-founded concern that the computers can eventually affect very earthy things such as, for example, our daily price of natural gas for heating.

What is your attitude towards algorithmic trading?

We would like to hear your opinion below.