The next broker we are looking at is Saxo Bank.

Saxo Bank is the leading Danish broker within CFD contracts and stock trading. It is a broker, as most Danes know beforehand. But, however, they deserve a review and a critical viewpoint.

In the review, we rate them according to the usual parameters:

- Security

- Product selection

- Trading platforms

- Trading costs

- Charting package

- Customer service

- Demo account

- Bonuses

About Saxo Bank

Saxo Bank is a Danish investment bank specializing in online trading and investment. The company was founded in 1992 under the name of Midas Fund Brokerage by Lars Seier Christensen, Kim Fournais, and Marc Hauschildt. Midas was in the forefront of the media ever since, since they had very aggressive marketing methods and were called a “bucket shop”. In 2001, they changed their name to Saxo Bank.

Saxo Bank offer trading in currencies, shares, CFDs, futures, bonds, and commodities. More than 100 companies have white-labeled solutions with them. They have their headquarters in Copenhagen but have offices in the whole world.

Saxo Bank differentiates their customers from their number of trades per month. In order to open an account with Saxo Bank, you must deposit at least 50,000 kroner. You start with their “Classic Account”. If you take between 20 and 40 trades each month, you can be upgraded to a “Premium Account”, where you get a few more benefits in terms of slightly reduced costs and a few more features such as a stock screener. If you have over 40 transactions per month, you can get a “Platinum Account”. Here you get the lowest spreads and most features.

Security at Saxo Bank

The security at Saxo Bank is high.

They are regulated in Denmark and are under strict supervision of the Danish Financial Supervisory Authority and members of the Danish Guarantee Fund, which means a guarantee of 100,000 Euro. Therefore, customers’ money is in good hands. Unfortunately, it is possible to lose more than your account balance, which occurred to a large number of customers in January 2015, when the floor of the Swiss franc was removed, causing Saxo Bank a huge loss of around a billion dollars – and their customers a large amount as well.

Products at Saxo Bank

Saxo Bank offer a wide range of products. They cover all the important markets. Here’s what they offer trading in:

- Shares (both in terms of CFD contracts and real shares)

- Commodities

- Forex

- Stock indices

- Options

- Bonds

- Futures

The need should then be covered for the majority of traders. They do not offer any junk products, such as binary options, which is a plus.

Trading platform at Saxo Bank

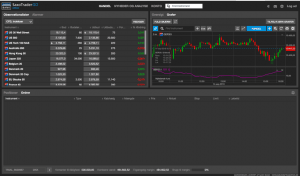

Saxo Bank have two trading platforms, SaxoTraderGo and SaxoTrader. SaxoTraderGo is web-based and it is the one we have looked at in this review. However, SaxoTrader should be more advanced and have more features, but on the other hand an ugly and outdated design. It can also be run on Windows only.

The first impression of SaxoTraderGo is good and professional. The design is nice and modern and the platform itself is quite flexible. SaxotTraderGo can of course also be accessed via smartphone and tablet.

A plus here is that you can choose Danish as a language. This means that everything on the platform is in Danish and has Danish terms.

Trading costs at Saxo Bank

Their spreads are at the high end when we compare with the competitors. We have looked at the trading costs of a “Classic Account” on CFD contracts. Their spreads are variable, which means they may well be higher than indicated when there is low liquidity in the market.

Here are their average spreads in the most popular markets:

- DAX: 1.5 points

- Dow Jones: 3 points

- EURUSD: 2 points

- EURGBP: 3 points

- AUDUSD: 3 points

- USDJPY: 2 points

- GBPUSD: 3 points

- Crude Oil: 5 points

- Gold: 6 points

As mentioned, it is possible to reduce the trading costs if you exceed a certain number of trades per month, but we do not believe that the above spread is competitive compared to what we otherwise see in the market.

The charting package as a work tool

The charting package on SaxoTraderGo is very user-friendly. It is possible to trade directly from the graph and move around one’s orders via the graph, which is a positive thing.

You can either choose to view the price as a line graph, candlestick chart, bar chart and Heiken Ashi chart. Unfortunately, it is not possible to get the price shown as a Renko graph, which draws a little down. They have the most important indicators and generally, the platform itself is very easy to use and very user-friendly.

The drawing tools also work perfectly. It’s great that you have the ability to adjust the Fibonacci ratios. Entering orders can be done using the buy and sell buttons as well as with limit orders. Here you also have the option to attach a trailing stop loss.

Customer service at Saxo Bank

As most others, Saxo Bank has a support center which answers most questions. In addition, you can contact them by phone and email. However, the opening hours of the phone are not displayed on their website. It’s a minus that it’s not possible to get in touch 24/5 via phone or a live chat. However, it is positive that support is offered in Danish.

Demo account at Saxo Bank

They offer a demo account like most other brokers. At the demo account, you have the opportunity to test the platform and get used to the conditions. However, it is limited to 20 days, which is negative. 20 days is probably not enough for most people. We would like to see a month as a minimum.

Saxo Bank does not operate with bonus

They do not offer any kind of sign up bonus or other forms of Greek gifts. We see this as a positive thing since a bonus typically is quite difficult to realize it and it typically hurts more than it benefits traders. Many new traders may appear to trade more frequently to get the bonus paid. But it’s far from good to trade very often. It can of course work for some traders, but our experience is that, as a new trader, you should rather focus on good and well-considered trades and not just trade to get a bonus realized.

Overall rating of Saxo Bank

- Security – 4 points

- Product range – 4 points

- Trading platform – 4 points

- Trading costs – 3 points

- Charting package – 4 points

- Customer service – 3 points

- Demo account – 3 points

- Bonus – 5 points.

Overall Rating: 3.8 out of 5.0

Saxo Bank is clearly a professional broker that exudes quality. One’s money is in good hands and it may seem safe that they are regulated here in Denmark. They have a reasonably large product range that is satisfactory. However, trading costs are at the very high end. We miss customer support available 25/5. But generally, Saxo Bank is a good and solid broker.

Comments to the review

What are your experiences with Saxo Bank?

We would like to receive comments with your own experiences from Saxo Bank, good and bad. Thanks!