We have now reached FXCM in the series of our reviews of popular brokers and trading platforms for daytrading.

In the review, we evaluate them on the following parameters:

- Security

- Product selection

- Trading platforms

- Trading costs

- Charting package

- Customer service

- Demo account

- Bonuses

At the end of the article, we give them an overall assessment based on the above.

About FXCM

Forex Capital Markets – also called FXCM – is one of the largest retail brokers in the industry. FXCM is registered in the US and listed on the NYSE (New York Stock Exchange). The company was founded in 1999 and is therefore well established.

FXCM offer CFD trading with Forex and stock indices. It’s also those who own the news and trading website DailyFx.com. Additionally, they provide data for most markets on Tradingview.com. That is where I have come to know them.

They offer three different trading platforms and three types of accounts. We will discuss those later in the article.

Security at FXCM

At FXCM, up to 50,000 pounds are secured, as they are regulated in England (this applies to Danish customers as well). This is of course a positive thing. However, there is a possibility of negative balance, so you can easily lose more than you have deposited in your trading account. Of course, this is clearly a minus.

Products at FXCM

The product range at FXCM is relatively limited. They are specialized in forex, but it is also possible to trade CFDs in the form of commodities and stock indices.

Here’s what they offer:

- Shares (few big shares)

- Stock indices

- Commodities

- Forex

- Bonds (only the German Bund)

However, it is only possible to access shares via the MT4 platform (MetaTrader4). Most markets are covered here and for the usual daytrader, the product selection should be satisfying. As said, they specialize in Forex, so it is clearly here they are strongest.

Trading platforms at FXCM

They provide five platforms for trading.

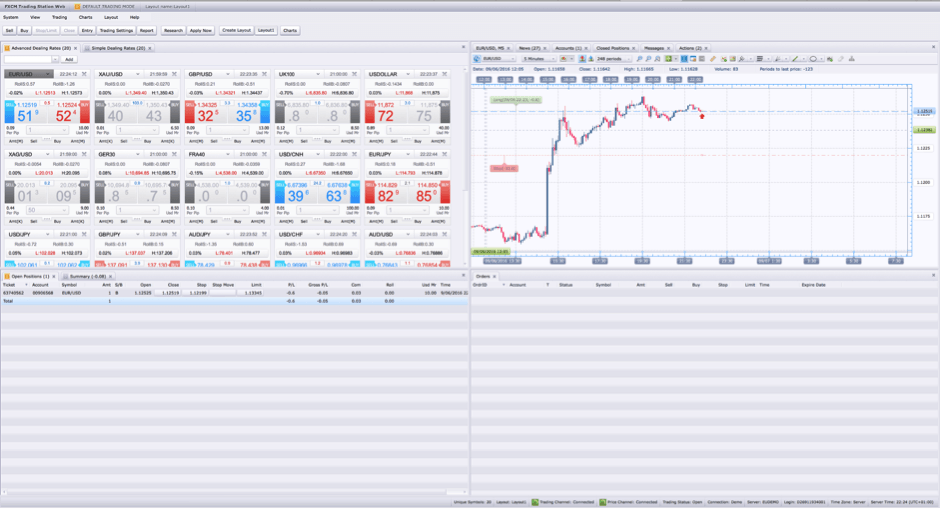

We focus on the notification primarily on their own platform: Trading Station.

Trading Station

This is their web-based platform and is the most popular of the five. It is relatively easy to access and easy to use.

The design is a personal thing, but I do not think it’s that nice. A plus here is the possibility of trading directly from the chart and moving around orders visually. Another very nice feature is that once you finish a trade, an arrow pops up, illustrating where you went in and out as well as information about the trade. This can be quite useful if you as a daytrader have many trades during a day and later have to log them in your logbook.

Metatrader 4

They also offer the classic and well-known MT4 platform.

Here is the possibility of algorithmic trading and home-made indicators as well as all public indicators that people have made. The platform may be quite overwhelming at first, as the design is quite outdated and not very user-friendly, but it is something that you get used to over time.

That’s the one you need if you want access to shares.

The other three platforms at FXCM

- NinjaTrader

- Mirror Trader

- ZuluTrade

The last two platforms are specifically designed for algorithmic trading.

Zulutrade is a so-called social trading platform, where you can follow other traders and take the same trades as professional, skilled traders.

It is clearly a plus that there are so many platform options that cater to the many different needs of traders.

However, the language of the platform is English. In order for us to give the top grade 5 to the trading platform, there must also be a possibility that the language of the platform is in Danish.

Trade costs at FXCM

Their spreads are variable and it is, therefore, difficult to get a correct picture of the available spreads, as they vary according to the liquidity in the market. If it is very liquid, you can get some really tight spreads, but during news and bad times of the day, you can encounter very high spreads.

In addition, they have three account types.

Mini Account

On their Mini Account, you pay only the spread and no commission. You can create a Mini Account for just $ 50.

Here, however, there are fixed spreads. They are, on the other hand, slightly higher than, for example, SpreadMarket.com and others. Who also operate with fixed spreads and no commission.

- DAX: 1 point

- Dow Jones: 2 points

- EURUSD: 1.5 points

- EURGBP: 2.2 points

- AUDUSD: 2.1 points

- USDJPY: 1.5 points

- GBPUSD: 2.3 points

- Crude Oil: 5 points

- Gold: 5 points

Standard Account

On their Standard and Active Trader accounts, you pay a low spread and then a commission.

To open a Standard Account, you must deposit $ 5,000 in the account as a minimum. When you add spreads and commissions together, you get a little lower spread on this account type than on their Mini Account.

Active Trader Account

On their Active Trader Account, you get their lowest costs.

In order to create an Active Trader account, you must have at least $ 25,000 in your account. However, it is only on Forex that you get lower costs. On index and commodities, trading costs are the same as on their Mini Account.

Your trading costs on forex are low if you have an Active Trader account, but on index and commodities, they are the same as most other places. If you just have a Mini Account, then their spreads are not better than so many others.

The charting package as a work tool

The charting package on FXCM’s web-based trading platform works well technically and is easy to use.

However, the design is not as nice as it could be. You can only choose between viewing the chart as a candlestick chart, line graph or bar chart. This is a bit of a minus and we miss the Renko graph. There could be improvements here.

There is a total of 59 indicators, which include the most famous and a few that I have not heard of before. Here, most daytraders should be satisfied.

Entering trades is straightforward. This is done through the buy and sell buttons. You can also choose to trade via the graph, which is a great advantage.

Unfortunately, FXCM does not offer guaranteed stop-loss and it is clearly a minus. It’s a must to have as a daytrader.

Customer service at FXCM

Their customer service is top.

I have been in contact with their online chat support several times, who were excellent. They are available with live chat support 24 hours a day, five days a week and available on the phone 24/7. It is clearly a plus that they are so easy to get in contact with.

Demo account at FXCM

It is possible to create a demo account with no time limit.

However, you must keep in mind that relationship on a demo account does not always represent the conditions of a live account. For example, there may be low liquidity and as a result, you may experience better prices on the demo account than on a live account.

FXCM does not make use of bonus

They do not currently use bonuses to attract customers, which we see as a positive sign and an expression that they are serious and do not need to market themselves in that way.

Overall rating of FXCM

- Security – 3 points.

- Product range – 3.5 points

- Trading platform – 4 points

- Trading costs – 3.5 points

- Charting package – 4 points

- Customer service – 4 points.

- Demo account – 4 points.

- Bonus – 4 points.

Overall Rating: 3.8 out of 5.0

FXCM is clearly a good broker and is a serious competitor to the brokers we have previously reviewed. If you trade a lot in Forex, then this is a good option, but you should have enough capital to create an Active Trader account so you can have access to the low trading costs. If you do not have enough capital, FXCM is not much better than so many others. In fact, their spreads are higher than Spreadmarket. But all in all, a good example of a serious broker.

>> You can sign up for FXCM here <<

Disclaimer: We do not receive any payment for this review. All ratings and attitudes in this article are as objective as possible and are not produced in collaboration with FXCM. FXCM is neither advertiser nor sponsor at DaytraderLand.com. If you sign up for the FXCM trading platform through the above affiliate link, the writer will receive a smaller commission from FXCM as part of their affiliate program.

Comments to the review

What are your personal experiences with FXCM?