What is a daytrader? Let’s start out by getting the terminology right.

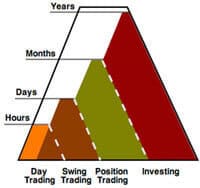

The term daytrader comes from the fact that the trades in let’s say stocks, options, futures or forex are lasting within a day’s time and are often very short term.

A daytrader is defined by a person who trades stocks, intstruments, certificates and so on, on a very short term basis and often with gearing (that is, fully or partially borrowed money).

Gearing means that if there is just a small price fluctuation on the instrument traded, it can result in a big win or loss on the trade – so to reduce the risk as much as possible, daytraders are only in a trade for minutes and up to a few hours at a time and never inbetween the opening and closing times as there is the risk of big and unforeseen swings.

Some daytraders make a few trades a day while others take hundreds of trades. It depends a lot on the strategy and the market.

A Daytrader always closes his trades at the end of every day, while a so called swingtrader keep the positions open for several days.

Generally, there are three types of daytraders:

- Individuals, who daytrade their own capital.

- Institutional daytraders, who works for financial institutions and have access to large amounts of capital, lightning-speed execution, high-end software etc. They have a lot of advantage over the retail daytrader.

- Daytrading robots, which are programmed for automatic trading on precise calculated algorithms.

In our series of articles with Daytraders, you can read interviews on some of the personalities in the daytrading community in Denmark.