Which daytrading markets can I daytrade?

When you start daytrading it is important to make it clear which markets you want to trade and what types of instruments to trade.

Generally, these are the most popular markets:

- Commoditites (crude oil, gold and silver etc.)

- Indices

- Forex

- Single stocks

In this article we will go through the different markets and their special characteristics.

Commodities

Oil and gold are some of the important commodities that you can trade on most platforms.

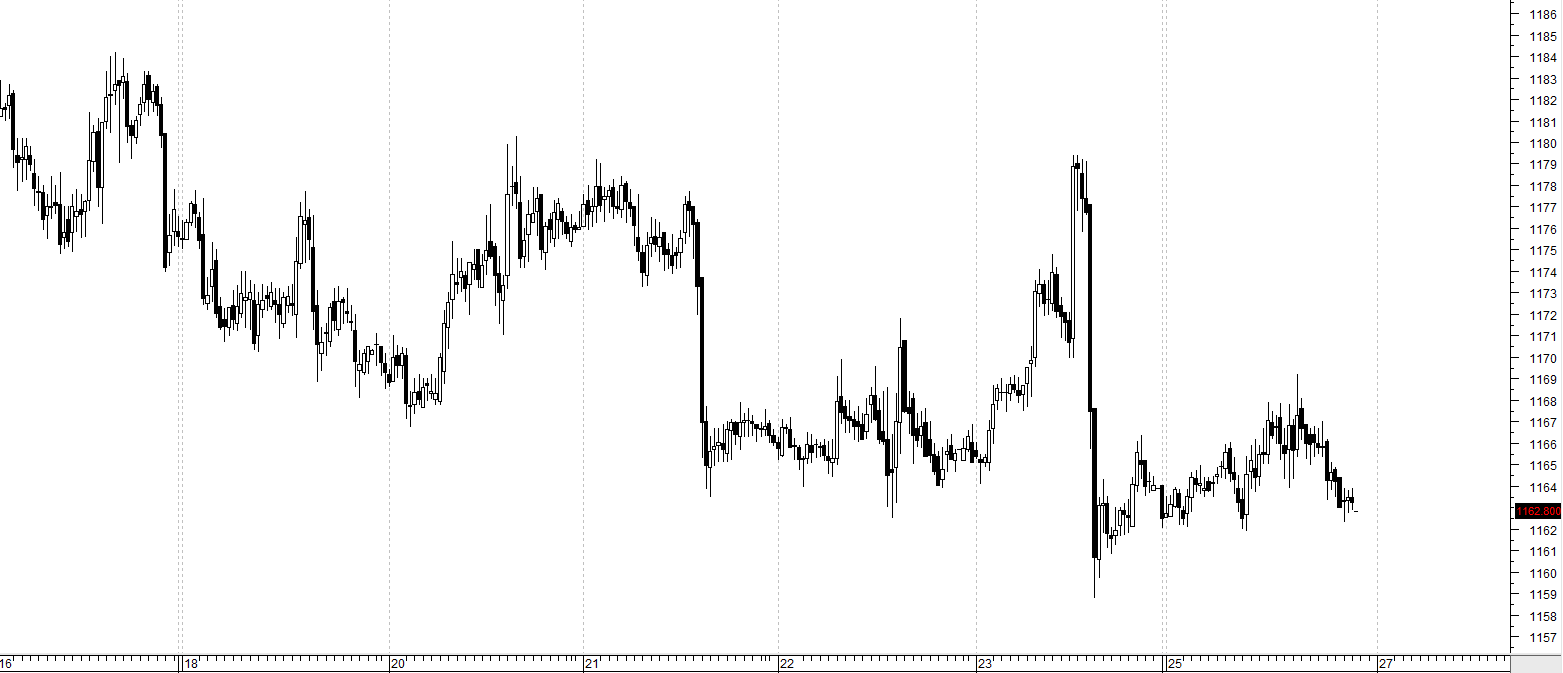

Here you see a chart of the gold price in USD over a weeks time (every bar is 30 minute).

As the chart above shows, there are periods of very low volatility where there will not be much money made and also periods of high volatility where the market goes in one direction and the possibility of making or losing money on daytrading is much bigger.

It is of course during the periods with big swings that the big money can be made – and very quickly. But if you get caught on the wrong side in a big drop or a sharp rise, it can cost a lot of money. For example, you could have made the bet that gold should rise and the price suddenly drops sharply. In this case, you would be long gold (that is, you make money if the price goes up, and lose if the price goes down).

If you want to daytrade commodities, it’s a good idea to get a hold of the fundamentals of for example the price of oil.

- Are there specific times a year where the price of oil is more volatile then others?

- Are there a higher probability for a rise or increase on certain seasons of the year?

- What events effect the price of oil?

All of this is relevant information to have in the back of your mind when you navigate in these markets.

Indices

An indice is a collection of stocks which are calculated to a certain value.

In Denmark most people know the designation C20 that describes a collection of 20 of the biggest stocks on the Danish stock exchange.

Normally when a daytrader trades indices it is usually some of the biggest and most liquid indices. This could for example be:

- DAX – the german stock indice (read our separate article about DAX)

- FTSE – the English stock indice

- DOW – the biggest companies in America

- Nasdaq – the biggest technology companies in America

- SP500 – the 500 biggest companies in America

Which indice you choose is dependent on both the opening times (it needs to fit your daily schedule and workflow) and the volatility in the specific market (how big swings you can withstand).

If you for example live in Denmark and have a full-time job during the day but want to daytrade indices, then the American DOW indice or the SP500 could be interesting markets to trade because they open in the afternoon (gmt+1) and close in the evening.

Forex

Daytraders use different words for forex trading. It can be Forex trading, FX trading, currency trading etc.

A currency is always traded against another and this is why you talk about forex crosses. It could be the EURUSD (Euro / US Dollar), EURJPY (Euro / Yen), and so on.

The forex market is the biggest and most liquid market in the world and beats the stock market in terms of volume per day.

Therefore, a great deal of new daytraders start out by trading forex because there is almost always liquidity, there is a high volume, it takes a lot to move the price violently (as when there are interest rate decisions etc.) and the market is also open 24/5.

Single stocks

Daytrading single stocks can be very lucrative, but it is also the type of instrument where the risk is the highest.

If you daytrade with a geared position (for borrowed money) and suddenly there comes a specific news announcement about the company you trade, then it can make the price explode.

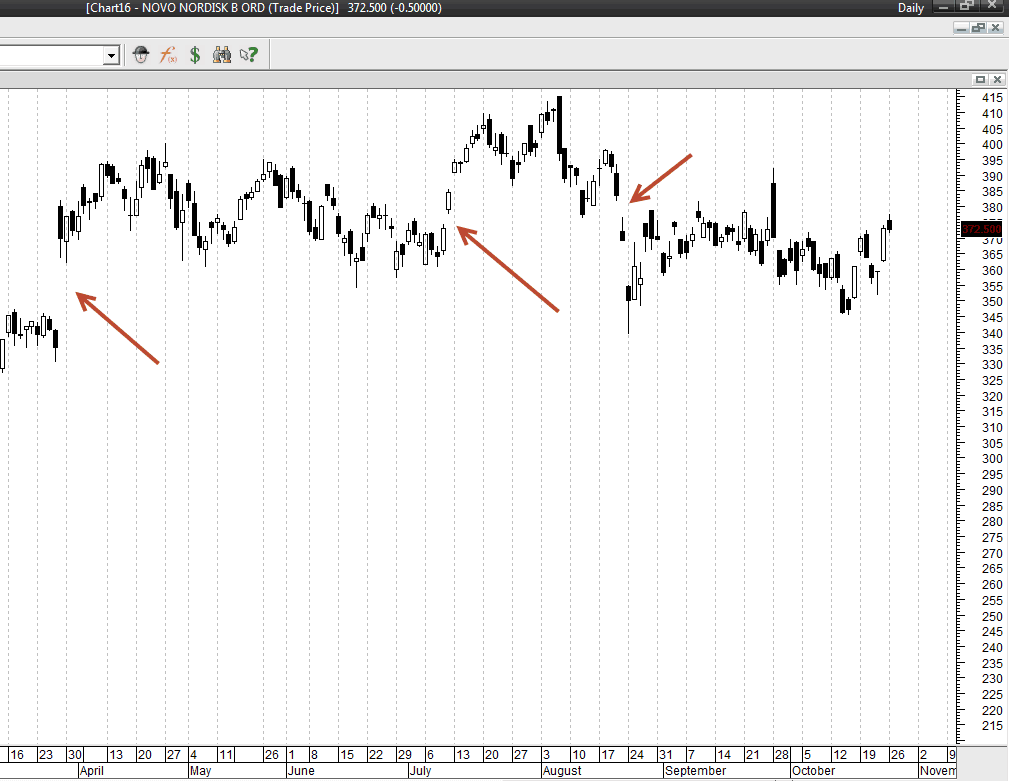

For example, if you daytraded this Danish stock, Novo Nordisk in 2015 and was unlucky on one of the days marked with red arrows beneath here, then you would have experienced a market which gaps, that is, the price opens either lower or higher than the closing price where you cannot get in or out the stock.

If you are on the right side of the market you can make a fortune but it can be catastrophic if you have made the wrong bet.

So, daytrading in single stocks is normally recommended only to the very experienced daytraders that practice good risk management.

Daytrading – which market should I choose?

As described above, you need to consider different things when you choose a market to daytrade.

You have to consider:

- Volatility – How big swings in the market can I manage?

- Opening times for the market – How do they fit my daily rutine?

- Products – What options does my broker provide for trading this market?

- Spread – What are the costs of trading this market?

- Risk – How big is the risk for unexpected gaps?

- Liquidity – What are the options of getting in and out of the market?