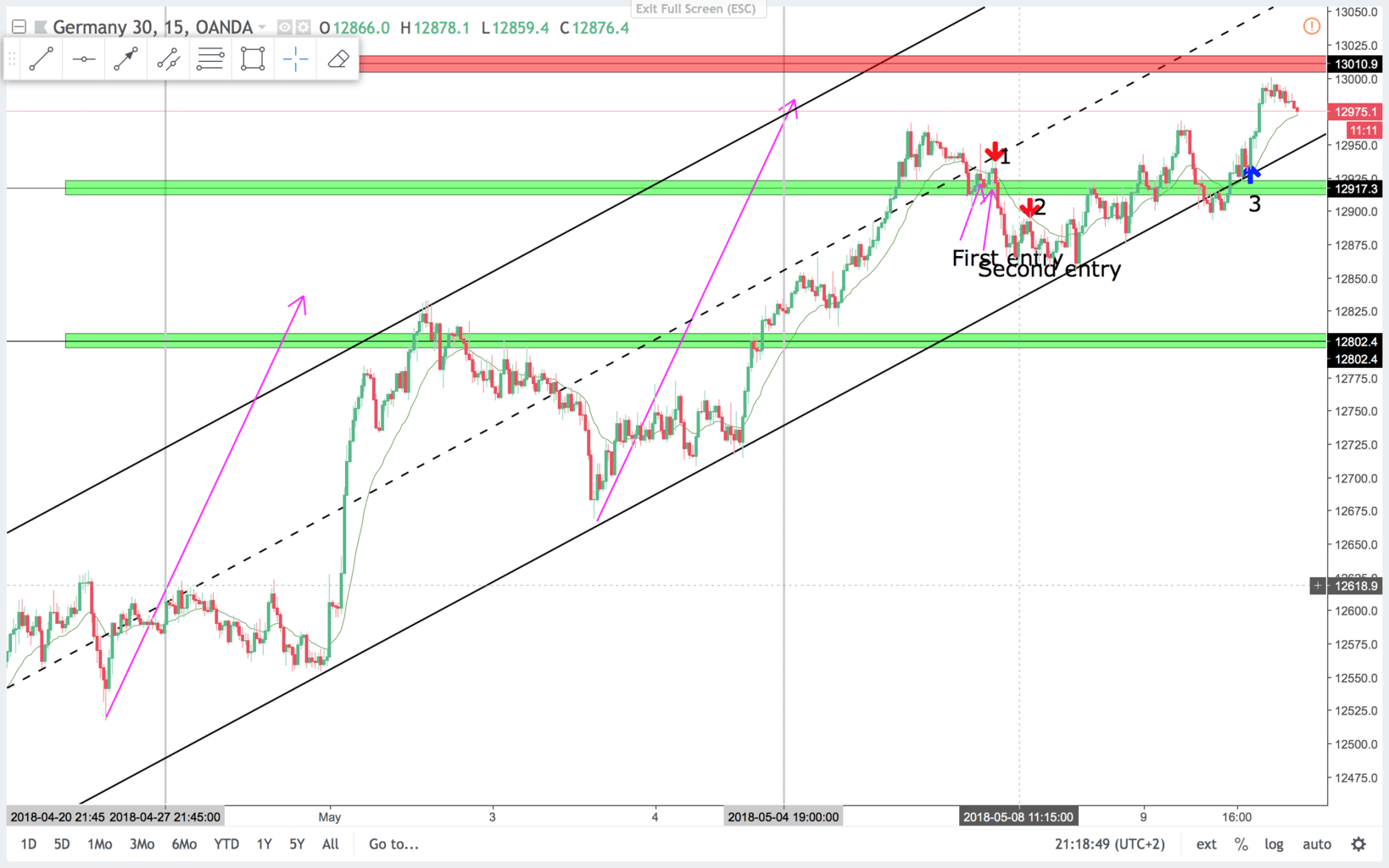

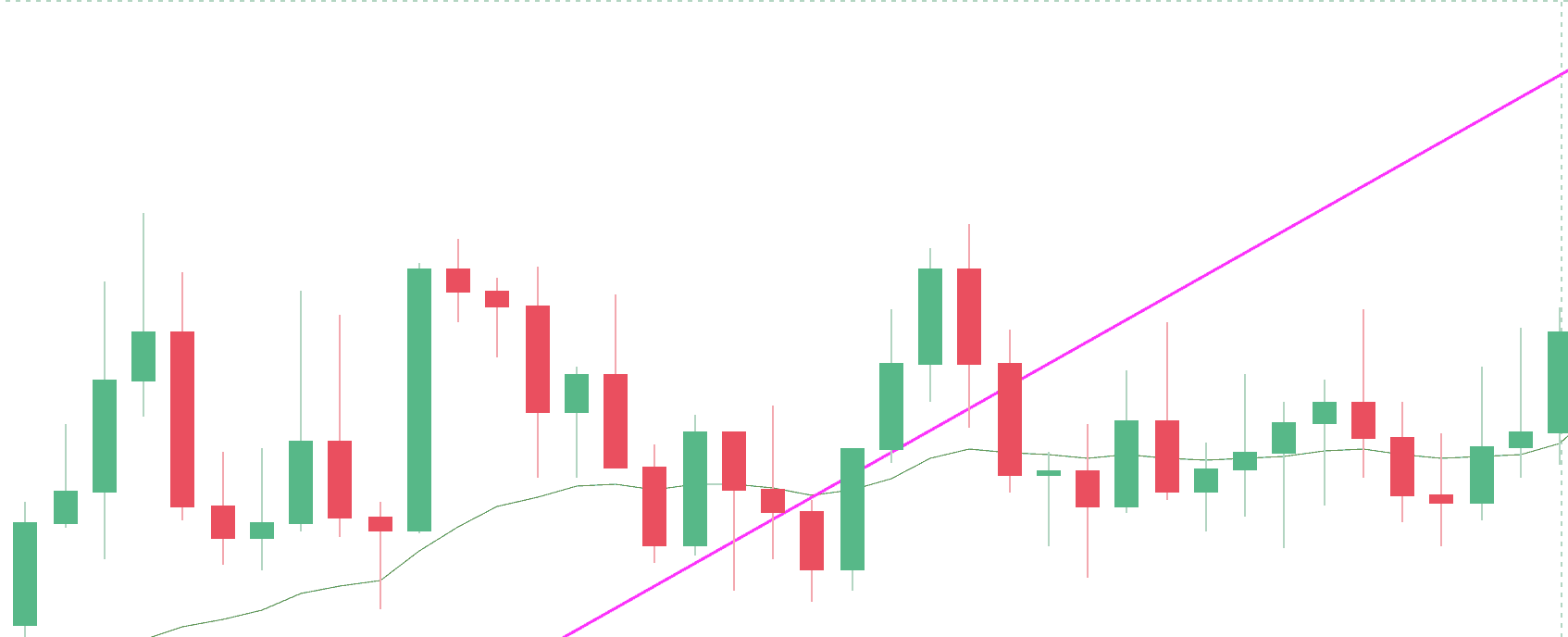

15 min chart:

This week kept bouncing on the bull trend line from last weeks bull channel. Price has had a hard time reaching the channel line(still hasn’t). That means more resistance, and probably a transition into a trading range is on the way. I picket three second entry trades to write about today. The second entry is one of the better tools in a price action traders toolbox, but is only a good trade in the right context.

The first entry in a bear trend is when price starts to correct up, and the first time a bar makes a low below the past bars low. This will get more clear later in the article.

Trade 1:

15 min chart:

On the 15 min chart this is a second entry sell signal. The first entry was when price went below the large bear bar with the long tail above.

The second entry happened on the signal bar(below the red arrow). But the signal bar was a the bar before. This was a bull doji bar with a tail below. I like to wait for a better signal bar. Preferably a bear bar that closes on or near the low. The bar below the red arrow was prof enough for me to risk this open sell setup.

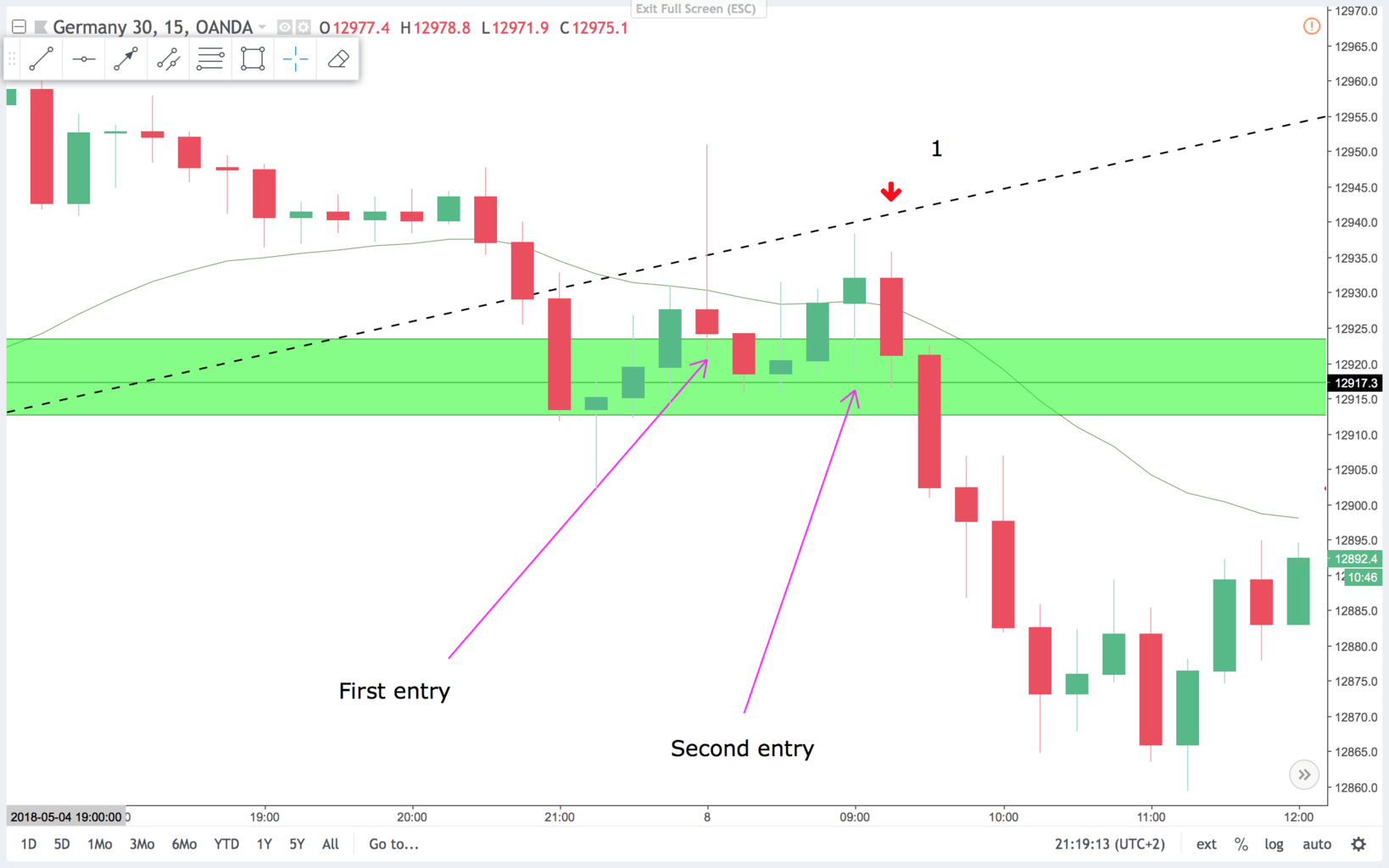

Trade 2:

5 min chart:

On the 5 min chart before the first entry signal, you had a strong bull leg. six bull bars, several of them closed on or near the highs. This increases the probability of a retest of bull strength, and is a sign to wait for a second entry. The second entry is two bars before the signal bar(below the red arrow). Again the signal on the second entry was weak, so wait for a proper signal bar. That came on the next bar. It had a break higher that failed, and bounced on the resistance line. This is a nice setup. The first second entry signal was not perfect, but with patience you got a better signal and better context.

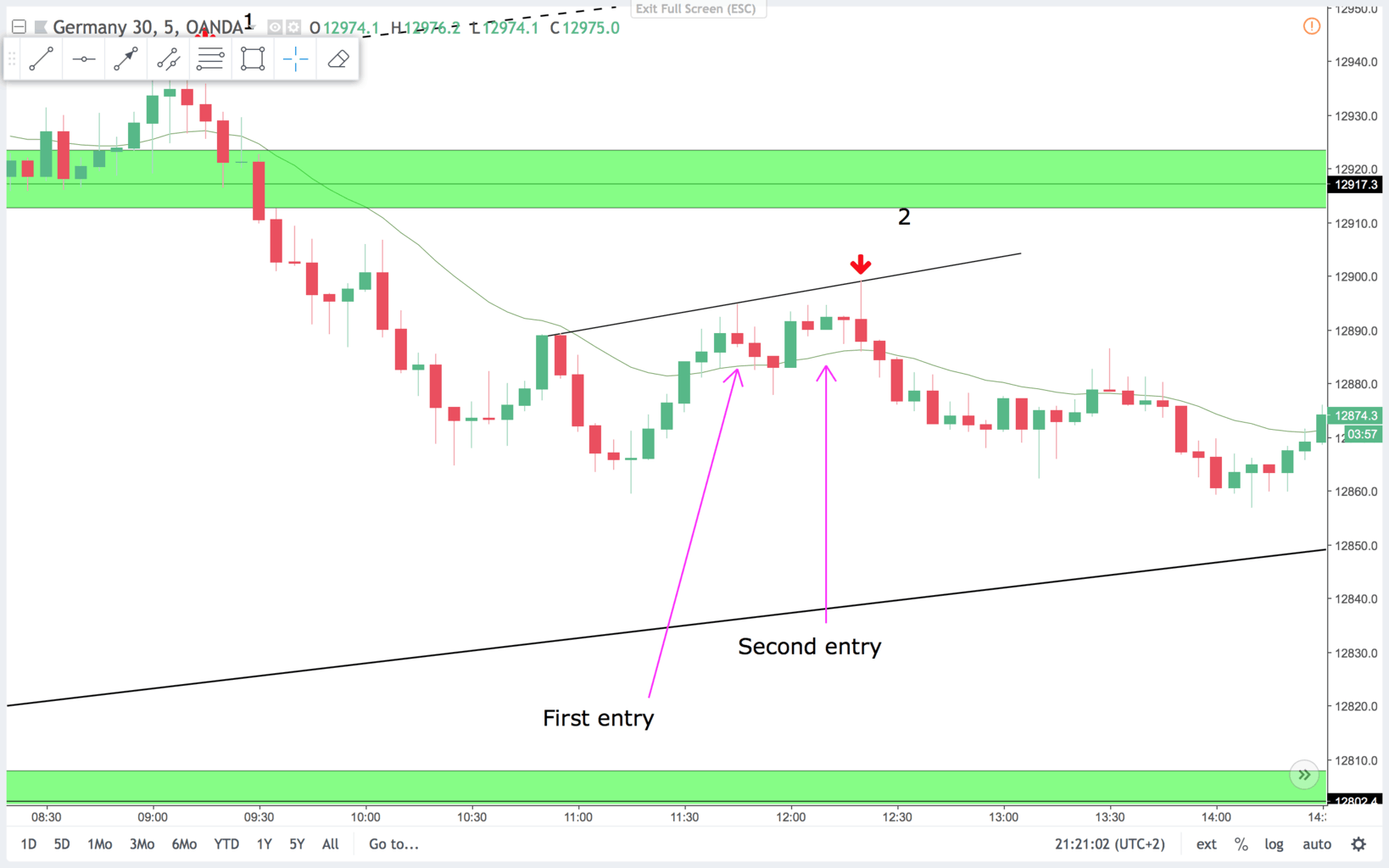

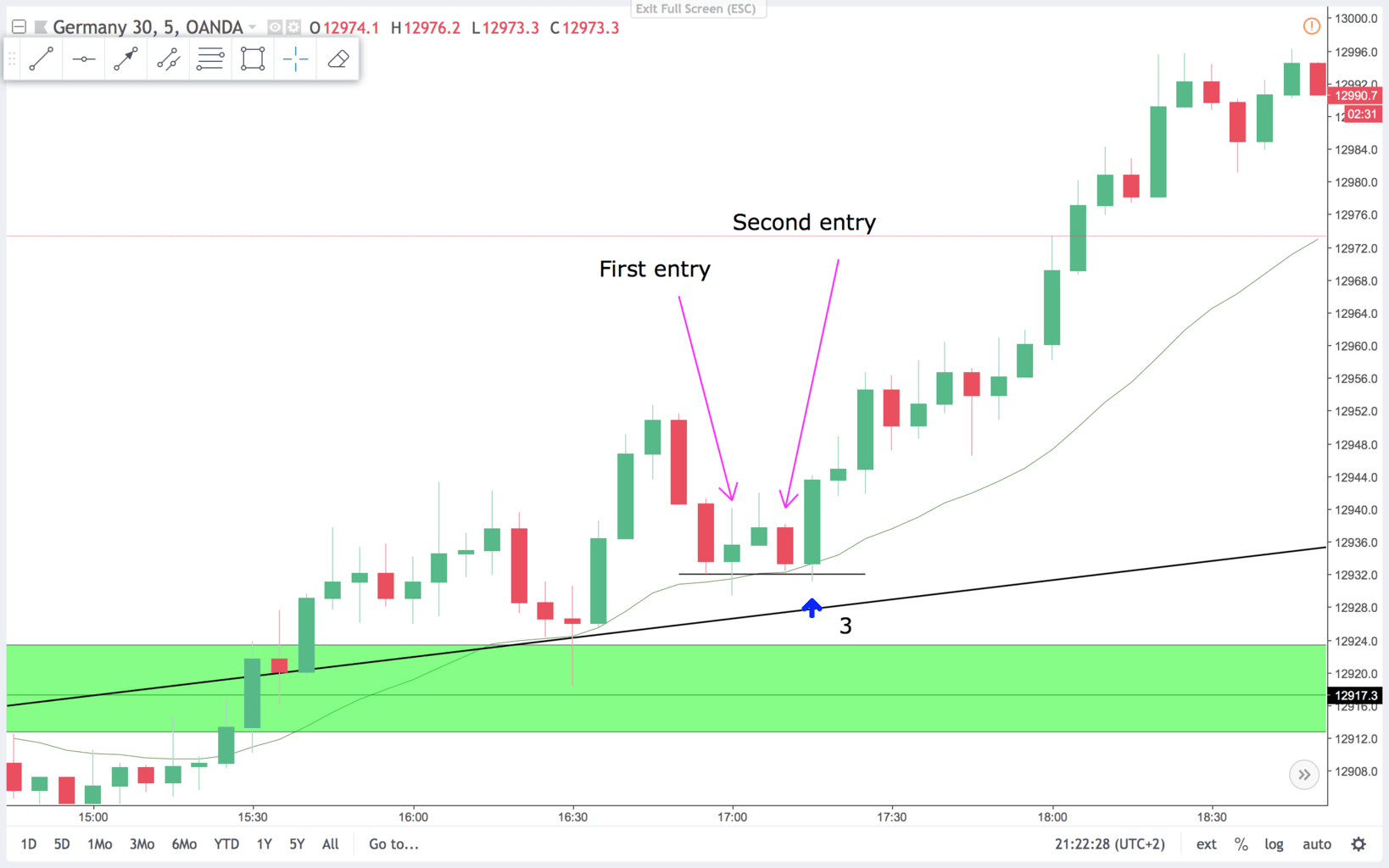

Trade 3:

5 min chart:

On the 5 min chart this second entry was a buy setup. The context was a bull trend higher highs and lows. You just got a strong three bar bull break out followed by a bear reversal attempt. Price testet the area where the bull break out started. Probably found limit order bulls waiting to get in long. The first entry was after a bull doji and the second entry was after a bear bar that closed on the low. The entry bar(bar above the blue arrow) on the second entry was a strong bull that closed on the high. I like that for a long. This setup is also a double bottom bull flag setup.

Second entries is a great tool. Often you have to make compromises to the setups. You do not always get perfect measured moves before a second entry. You do not always get perfect signal bars or risk rewards. But if you are able to read a couple of more signs that speaks in favor of the second entry signal, the probability of the signal goes up and makes for a positive traders equation.

Example of bad context for second entry signals:

5 min chart:

Have a nice trading week.